Long-Term Unemployment Has Quadrupled, and That’s a Problem for the Economy

Last Updated April 1, 2021

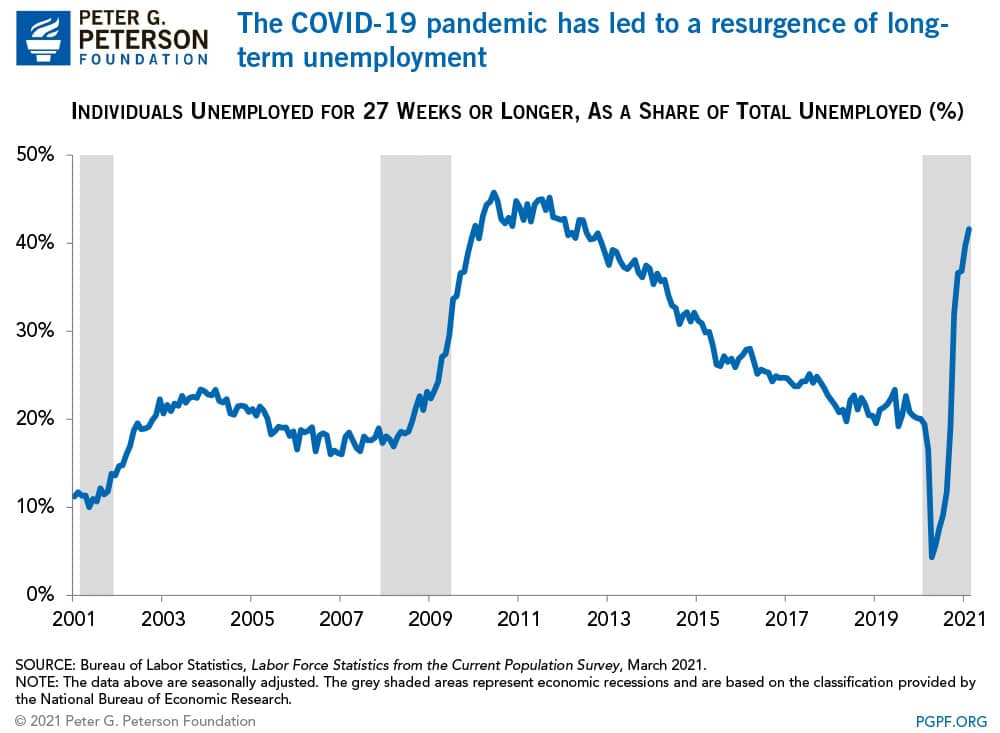

The number of individuals experiencing long-term unemployment (lasting 27 weeks or longer) has quadrupled during the coronavirus (COVID-19) pandemic, growing from 1 million in February 2020 to 4 million in February 2021. The long-term unemployed now account for 42 percent of all unemployed workers, up from 19 percent before the pandemic. Such long-term unemployment causes significant harm to individual workers and the economy.

Long-term unemployment can have long-lasting effects. The Bureau of Labor Statistics has found that an individual’s wage trajectory is depressed for years after a spell of long-term unemployment. Other research shows that once an individual experiences long-term unemployment, they are less likely to ever find another job — regardless of their demographic characteristics.

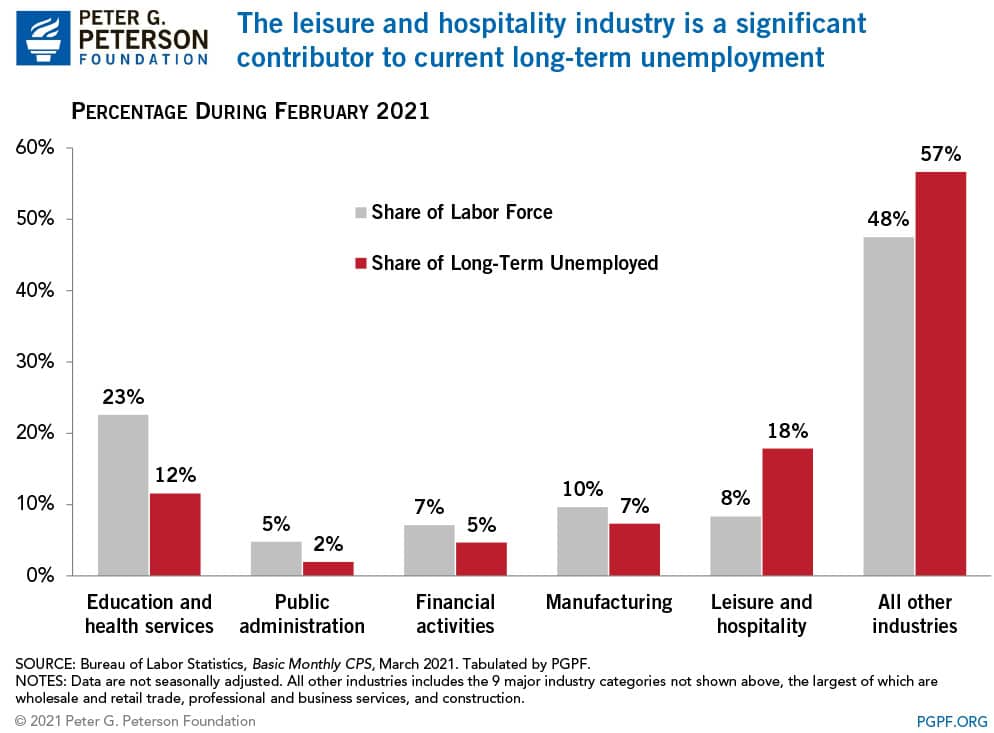

No worker is immune to the challenges brought on by long-term unemployment, but those currently facing long-term unemployment in the United States have characteristics that distinguish them from the labor force as a whole. For example:

- The labor force is 61 percent white, but only 47 percent of the long-term unemployed are white. By contrast, black workers comprise just 12 percent of the labor force, but account for 20 percent of the long-term unemployed.

- Individuals with less than a bachelor’s degree make up 60 percent of the labor force, but individuals with those levels of education represent 69 percent of the long-term unemployed.

- While the leisure and hospitality industry only accounts for 8 percent of the labor force, former workers from that industry account for 18 percent of the long-term unemployed.

Such hardships at the individual level amount to a significant challenge for the economy as a whole. The World Bank highlights the connection between long-term unemployment and the growth potential of the economy:

“Deep recessions inflict lasting scars on potential output through lower investment and innovation; erosion of the human capital of the unemployed; and a retreat from global trade and supply linkages.”

Diane Swonk, chief economist for Grant Thornton, also points to the broad effects of the current wave of long-term unemployment:

“The wounds [COVID] has inflicted on the labor market have begun to fester and could deepen. The loss of earnings and educational attainment could set us back an entire generation. Inequality could worsen, which will exacerbate the political divisions we see and even undermine the functioning of democracy, thereby slowing the pace of the recovery when the pandemic abates.”

The Peterson Institute for International Economics notes that while there is reason for hope, the long-term unemployment situation has the potential to be a drag on the labor market recovery:

“If the virus is brought under control, the economy should have sufficient aggregate demand to support rapid growth in 2021. This demand would be satisfied by putting millions of workers back to work and bringing millions more back into the labor force. The challenges of a speedy labor market adjustment grow the longer and worse the underlying unemployment situation gets.”

While the immediate health hazards of the COVID-19 pandemic are, fortunately, beginning to be addressed by the growing distribution of vaccines, many unanswered questions remain about the longer-term economic recovery. The answers depend in part on the fate of the individuals who are experiencing long-term unemployment as a result of the pandemic. Based on the available research, the nation’s overall economic recovery might be hampered by the large group of individuals who could struggle to contribute to the labor force at the same rate that they did before the onset of the pandemic.

Image credit: Photo by Michael Loccisano / Getty Images

Further Reading

National Debt Puts Upward Pressure on Inflation and Interest Rates

America’s unsustainable fiscal outlook can have “significant consequences for price stability, interest rates, and overall economic performance,” according to a new report.

Why Is the Federal Deficit High If Unemployment Is Low?

The U.S. is experiencing an unusual and concerning phenomenon — the annual deficit is high even though the unemployment rate is low.

What Is Inflation and Why Does It Matter?

Here’s an overview of inflation, why it matters, and how it’s managed.