Legislation to Fight Coronavirus Pandemic Has Reduced Federal Revenues by $500 Billion

Last Updated July 8, 2020

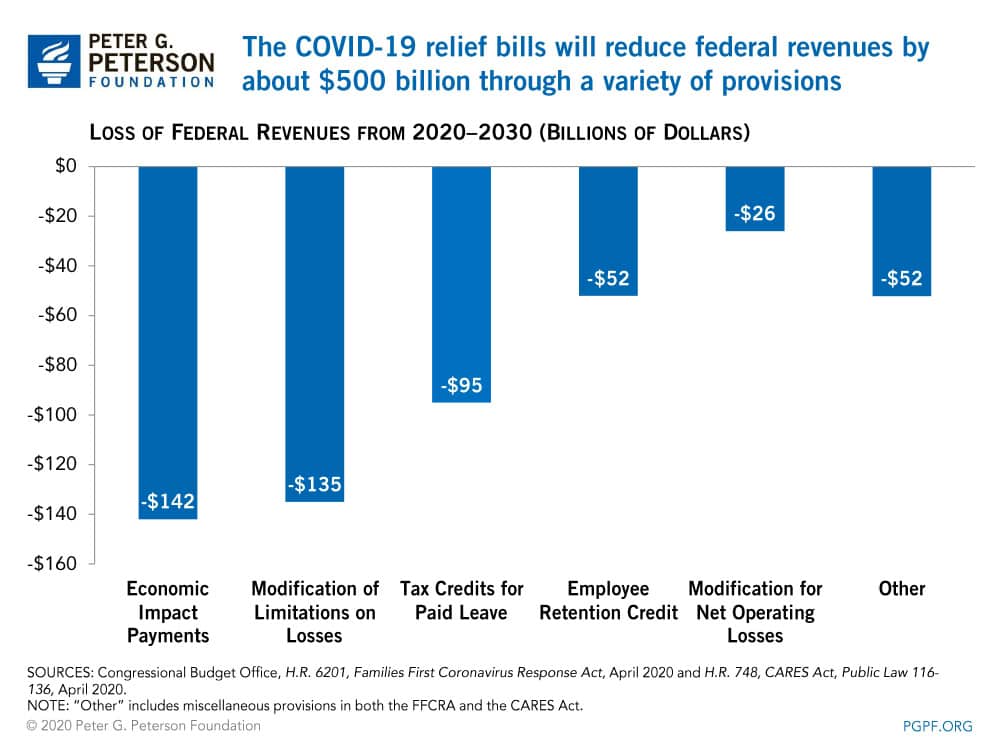

To date, policymakers have enacted four coronavirus (COVID-19) relief bills to provide economic support to taxpayers, businesses, healthcare providers, and state and local governments. Overall, that legislation is expected to widen the gap between federal outlays and revenues — increasing federal deficits by $2.4 trillion over the next decade. About $500 billion of that amount results from a reduction in federal revenues, stemming from various tax credits and tax incentives that were included in the COVID-19 relief bills.

Below is a breakdown of the major revenue provisions in those bills and their effect on federal receipts throughout the next decade.

strong>Economic Impact Payments. The Coronavirus Aid, Relief, and Economic Security (CARES) Act, passed on March 27, included direct payments to individuals as one of its key provisions to provide financial relief to Americans. Also referred to as stimulus checks, economic impact payments provide a refundable tax credit, which allows taxpayers a refund if their tax credit is greater than their tax liability, to individuals — typically around $1,200 per person or $2,400 for married couples, plus $500 per dependent child. The Internal Revenue Service has disbursed the majority of those payments over the past several weeks. Overall, the Joint Committee on Taxation (JCT) anticipates the payments will cost $292 billion through 2021; about half of that cost will be reflected in the budget as outlays since the payment may exceed the tax liability of the recipient.

Modification of Limitations on Losses for Taxpayers Other Than Corporations. This provision in the CARES Act enables individual taxpayers to offset their nonbusiness income for tax years 2018 through 2020 with 100 percent of their business losses. Prior to the CARES Act, taxpayers could only offset up to $250,000 of such losses. The JCT estimates that the provision will decrease federal revenues by $135 billion over the next decade.

Tax Credits for Paid Sick Leave and Paid Family Medical Leave. The Families First Coronavirus Response Act, enacted on March 18, required certain employers to provide emergency family and medical leave, as well as emergency paid sick leave, to employees through December 31, 2020. To offset the cost of providing that leave, the legislation created fully refundable tax credits for employers to use against payroll taxes. The credits are equal to 100 percent of qualified wages plus the employer’s contributions to health insurance premiums. The JCT estimates that such credits will reduce federal revenues by $95 billion and increase outlays by $10 billion, the majority of which would be incurred through 2021.

Employee Retention Credit. To incentivize businesses to keep employees on their payroll, this credit has been made available to employers who were required to close due to the pandemic and to employers who face a sizeable decline in revenues in 2020. The credit is equivalent to 50 percent of qualified wages paid by employers from March 13 through December 31, up to a maximum $5,000 credit per employee. The JCT estimates that the credit will reduce federal revenues by $52 billion through 2021 and increase outlays by $3 billion over the same period.

Modifications for Net Operating Losses. Prior to the CARES Act, businesses could offset up to 80 percent of their taxable income in a given year with any net operating losses they incurred in the previous year. The CARES Act modified that limitation so businesses can now offset up to 100 percent of their taxable income for net operating losses incurred over the three-year period from 2018 to 2020. This provision also allows businesses to carry back such losses for refunds of tax liabilities over the previous five years. The JCT estimates that such modifications will lead to a net $26 billion reduction in federal revenues throughout 2030.

Other. The CARES Act included a number of other provisions that affect federal revenues. For example, employers are able to delay payment of their payroll taxes from March 27 through December 31 of this year; half of that deferred amount would be due by December 31, 2021 and the remaining half would be due by December 31, 2022. While that provision will substantially delay tax payments for 2020, JCT estimates that most of those revenues will eventually be collected. Examples of other revenue-reduction provisions in the act include modifications of limitation on business interest expense deductions and an expansion of qualified medical expenses. Taken together, those “other” provisions will decrease revenues by about $50 billion throughout 2030.

Image credit: Photo by Chip Somodevilla/Getty Images

Further Reading

How Much Can the Administration Really Save by Cutting Down on Improper Payments?

Cutting down on improper payments could increase program efficiency, bolster Americans’ confidence in their government, and safeguard taxpayer dollars.

How Do Quantitative Easing and Tightening Affect the Federal Budget?

The Federal Reserve plays an important role in stabilizing the country’s economy.

Here’s How No Tax on Overtime Would Affect Federal Revenues and Tax Fairness

Excluding overtime pay from federal taxes would meaningfully worsen the fiscal outlook, while most of the tax benefits would go to the top 20% of taxpayers.