How Is the Debt Limit Deal Affecting a Potential Government Shutdown?

Last Updated September 22, 2023

In June, lawmakers avoided defaulting on the national debt by enacting the Fiscal Responsibility Act (FRA). That legislation suspended the debt limit and also established discretionary spending limits for two years. As lawmakers grapple with how to fund the government for fiscal year 2024, provisions in the FRA have reignited debates about spending levels and are complicating the legislative budget process. Lawmakers have not passed full appropriations for fiscal year 2024 (October 1, 2023, to September 30, 2024), but they passed a continuing resolution to temporarily fund the government through November 17, 2023. Because legislators still had not reached an agreement by that date, a second CR was enacted. However, that second CR extended funding in two phases — funding for agencies covered by four appropriation bills has been extended to January 19, 2024, and funding for agencies covered by the remaining eight bills has been extended to February 2, 2024. If lawmakers cannot agree on appropriation bills once that CR expires, there may be a government shutdown.

What is the Appropriation Process?

As defined by the House of Representatives, an appropriation is a law of Congress that provides an agency with budget authority. Appropriations allow agencies to incur obligations and to make payments from the U.S. Treasury for specified purposes.

In both the House and Senate, responsibility for appropriations is allocated across 12 subcommittees of the full Committee on Appropriations. The subcommittees are generally aligned according to particular government functions (for example, defense). Ideally, each subcommittee would report a separate bill, the House and Senate would come to an agreement between their versions, and the President would sign before October 1.

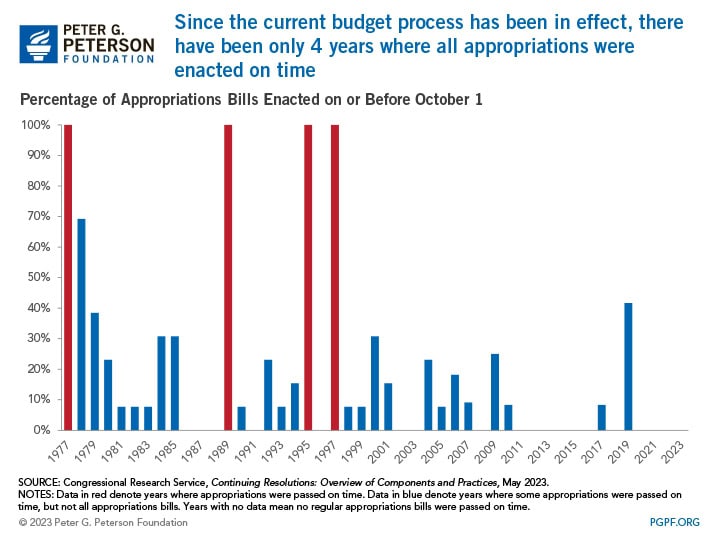

However, final appropriations are not typically completed before the beginning of the new fiscal year. Congress has only completed the process before the beginning of the fiscal year four times in the last 47 years, most recently for fiscal year 1997. If Congress fails to enact the 12 annual appropriation bills by October 1, a government shutdown could occur because agencies will not have authority to carry out most operations. Congress can avoid a government shutdown by passing a temporary funding bill, known as a continuing resolution (CR), which would allow governmental operations to continue. CRs expire after a designated timeframe (the current one expires on January 19, 2024 or February 2, 2024 depending on the bill), at which point Congress would need to agree on the 12 appropriation bills, send another CR to the President for signature, or risk a shutdown.

How Does the FRA Impact the Current Appropriation Process?

The Fiscal Responsibility Act affects appropriations in three ways:

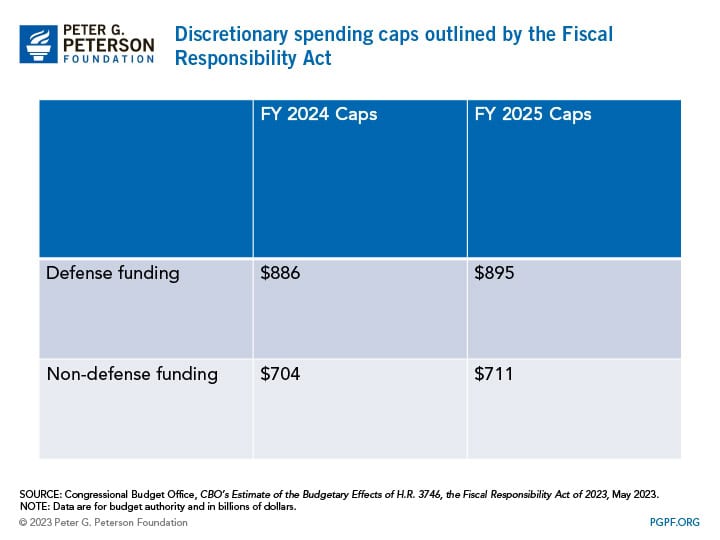

1. The FRA imposes caps on discretionary spending for fiscal years 2024 and 2025. The FRA set budget caps for defense and nondefense spending for the next two years.

Spending caps for fiscal year 2024 were agreed upon in the FRA, but some members of the House are attempting to provide budget authority substantially below those agreed-upon levels.

2. FRA rescinds some spending related to the pandemic and for the Internal Revenue Service (IRS). Previously, the Inflation Reduction Act provided the IRS with $79 billion in mandatory funding from fiscal years 2022 to 2031, but a provision in the FRA rescinds just over $1 billion of such funding. The FRA also rescinds almost $28 billion of unspent funds from pandemic-related accounts.

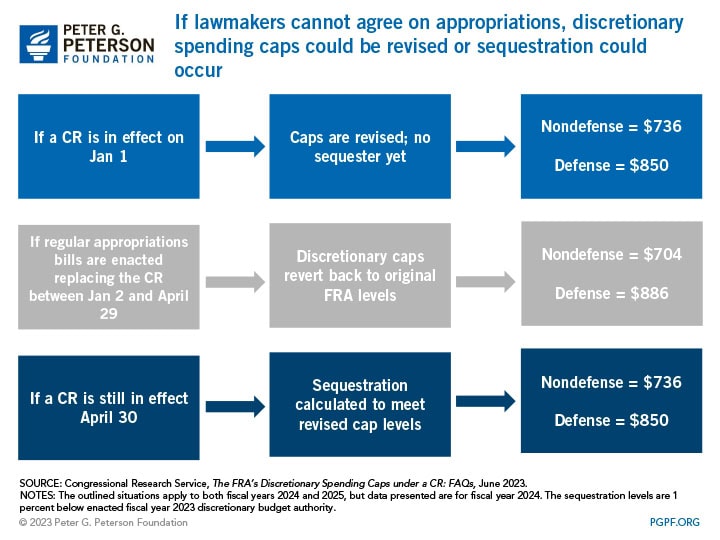

3. The FRA could force an automatic 1 percent reduction in resources if appropriation bills are not enacted. As an incentive to encourage lawmakers to complete their budgeting work, the FRA included certain provisions that could affect spending levels. If Congress utilizes a CR that is still in effect on January 1, the FRA caps would be replaced with caps reflecting a 1 percent reduction relative to the enacted levels for the previous year. The effect of such action would be a decrease in budget authority for defense relative to the cap set in the FRA but an increase in budget authority for nondefense. Caps would return to the original FRA levels if regular appropriation bills are enacted to replace a CR between January 2 and April 29 of either fiscal year. Sequestration would only take effect if a CR is still in effect by April 30, at which point discretionary spending would face an automatic and across-the-board cut to meet the revised caps (1 percent reduction from 2023, for example). Neither chamber of Congress passed all 12 appropriation bills before the end of the fiscal year, and to avoid a government shutdown they passed two CRs: the first of which expired November 17, 2023 and the second one will expire January 19, 2024 or February 2, 2024 depending on the appropriation bill. At that point, Congress will need to pass the 12 bills or another CR to avoid a government shutdown.

Conclusion

The beginning of fiscal year 2024 has already begun, and lawmakers will need to find a permanent solution to continue funding government activities beyond the expiration of the CRs. To avoid disruptions, lawmakers should focus on completing the appropriation process in a timely manner moving forward, which would allow for responsible consideration of competing spending priorities as well as acknowledge our unsustainable national debt.

Image credit: Photo by Chip Somodevilla/Getty Images

Further Reading

How Much Can the Administration Really Save by Cutting Down on Improper Payments?

Cutting down on improper payments could increase program efficiency, bolster Americans’ confidence in their government, and safeguard taxpayer dollars.

How Do Quantitative Easing and Tightening Affect the Federal Budget?

The Federal Reserve plays an important role in stabilizing the country’s economy.

Here’s How No Tax on Overtime Would Affect Federal Revenues and Tax Fairness

Excluding overtime pay from federal taxes would meaningfully worsen the fiscal outlook, while most of the tax benefits would go to the top 20% of taxpayers.