Here’s Everything the Federal Government Has Done to Respond to the Coronavirus So Far

Last Updated March 15, 2021

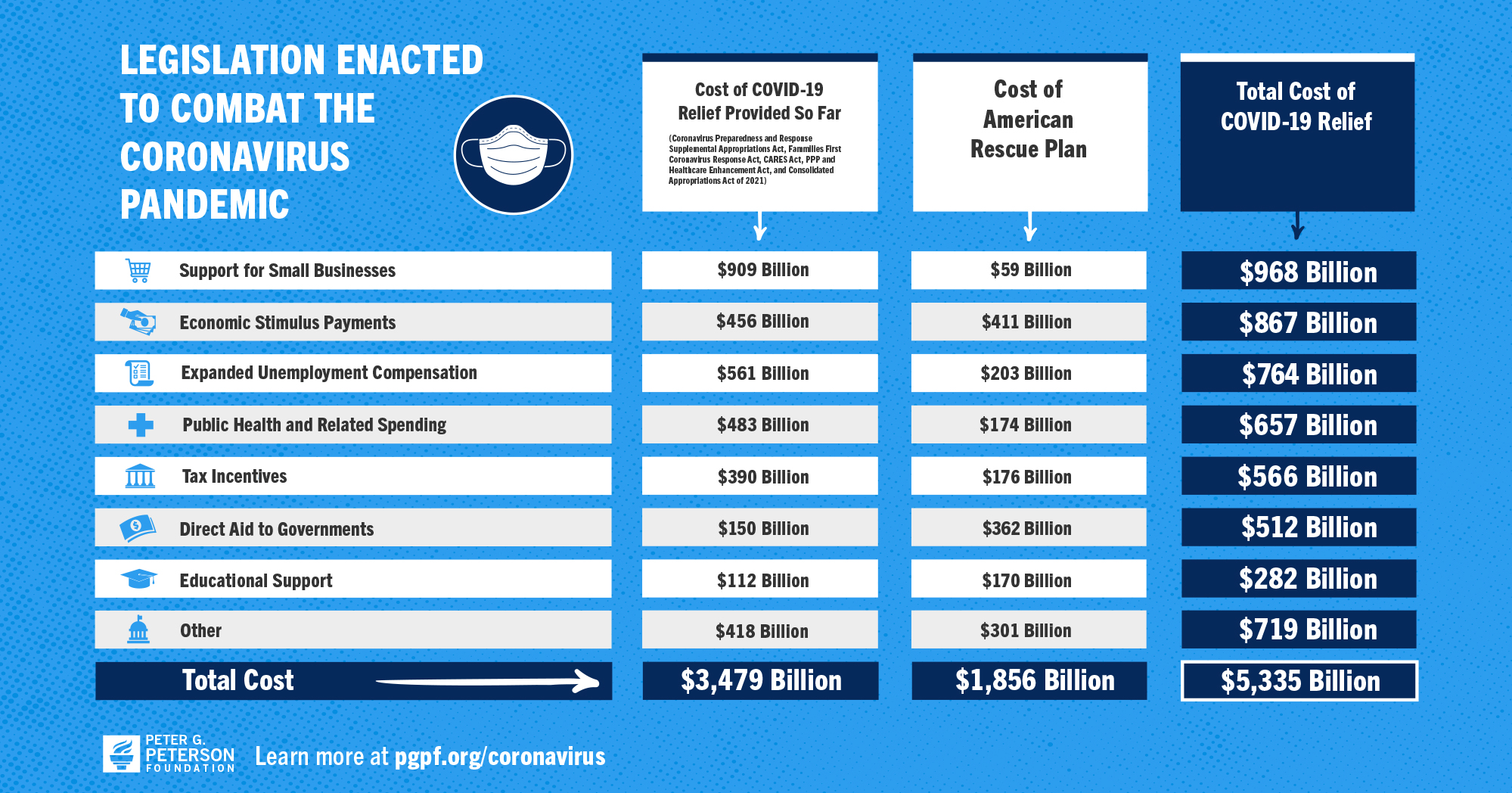

The coronavirus (COVID-19) pandemic has caused a severe public health crisis as well as substantial economic disruption for every American. So far, lawmakers have enacted six major bills, costing about $5.3 trillion, to help manage the pandemic and mitigate the economic burden on families and businesses. Below is a recap of that legislation.

The Latest Round of Legislation

The American Rescue Plan, which was enacted on March 11, 2021, provides an additional $1.9 trillion of federal relief in a variety of areas. Some of the key provisions in that bill include:

- Direct payments to individuals ($411 billion). Payments of $1,400 will be sent to individual taxpayers earning up to $75,000 ($2,800 for married couples earning up to $150,000), plus an additional $1,400 per qualified child. The payment will phase out for incomes up to $80,000 ($160,000 for married couples).

- Direct aid to state, local, and tribal governments ($362 billion). The bill includes additional support to such governments to help them respond to the pandemic.

- Extension of unemployment benefits ($203 billion). The unemployment programs currently in place, including the additional $300 weekly unemployment benefit, will be extended through September 6, 2021.

- Tax incentives ($176 billion). The legislation significantly enhances existing tax credits, mostly for one year. The Child Tax Credit will increase from $2,000 per child to $3,000 ($3,600 for children under 6) and the maximum benefit for childless households under the Earned Income Tax Credit will grow from $543 to $1,502 and be extended so more individuals can claim the benefit. Other tax credits, such as the Employee Retention Credit, are also extended or enhanced.

- Health-specific measures ($174 billion). The new bill provides funding for vaccine distribution, COVID-19 testing, contact tracing, and other public health measures. It also includes provisions to lower healthcare premiums and expand coverage for certain workers.

- Educational support ($170 billion). The majority of such support is to help K-12 schools safely reopen; colleges and other higher-education institutions will also receive funding.

- Other Programs ($301 Billion). The legislation also includes funding for small businesses, emergency rental assistance, mortgage assistance, and relief to prevent homelessness.

Previous Relief Bills

The five bills enacted previous to the American Rescue Plan are summarized below.

Coronavirus Preparedness and Response Supplemental Appropriations Act

As an initial response, policymakers enacted legislation in early March, 2020 that provided $8.3 billion in emergency funding for public health agencies and coronavirus vaccine research. That bill appropriated $7.8 billion in discretionary funding to federal, state, and local health agencies and authorized $500 million in mandatory spending through a change in Medicare.

Families First Coronavirus Response Act

On March 18, 2020 the Families First Coronavirus Response Act was enacted to provide economic support to those in need. That legislation, totaling $192 billion, included a number of key components, including:

- Enhancing unemployment insurance benefits

- Increasing federal Medicaid and food-security spending

- Requiring certain employers to provide paid sick leave as well as family and medical leave (and expanding tax credits for those employers to offset the cost of providing such leave)

- Providing free coverage for coronavirus testing under government health programs

The Coronavirus Aid, Relief, and Economic Security (CARES) Act

As a follow-up, lawmakers enacted the CARES Act, a relief package of around $2 trillion, on March 27 to address the near-term economic impact the virus is having on families and businesses. Some of the key items in the legislation include:

- Financial Assistance to Large Companies and Governments ($500 billion). Such funding will be used to assist companies that are critical to national security and distressed sectors of the economy. Of the total sum, about $450 billion will support loans to businesses, states, and municipalities through a new Federal Reserve lending facility. That support is not expected to increase federal deficits.

- Economic support for small businesses ($380 billion). That support was largely for the creation of the Paycheck Protection Program (PPP), which allocated $349 billion in funding through the CARES Act to offer as loans to small businesses to help them avoid laying off their workers. Additionally, portions of the loans spent on payroll, rent, or utilities are eligible for forgiveness.

- Direct payments to taxpayers ($290 billion). Taxpayers with annual incomes up to $75,000 (or $150,000 for married couples) received payments of $1,200; that payment amount gradually phased out for higher income earners with a cap at an annual salary of $99,000 (or $198,000 for married couples). Families also received an additional $500 per qualifying child. (See how taxpayers spent the first round of checks and what the economic effects were.)

- Further expansion of unemployment benefits ($270 billion). Such benefits were significantly expanded under the legislation — extending unemployment insurance by 13 weeks, boosting benefits by up to $600 per week for four months, and expanding eligibility requirements to include more categories of workers.

- Federal aid to hospital and healthcare providers ($150 billion). To help hospitals, community health centers, and other healthcare providers prepare for and respond to the pandemic.

- Various tax incentives. Businesses were allowed to defer payroll taxes, which fund Social Security and Medicare. A number of other tax benefits were also be provided; the largest effect stemmed from the ability of individual taxpayers to use business losses in recent years to offset nonbusiness income.

Paycheck Protection Program and Health Care Enhancement Act

On April 24, 2020 policymakers enacted the Paycheck Protection Program and Healthcare Enhancement Act. That bill, totaling $483 billion, provided an additional $383 billion in economic support for small businesses ($321 billion to replenish the PPP, $60 billion for emergency lending for small businesses, and $2 billion for salaries and expenses to administer such programs), another $75 billion in funding for hospitals, and about $25 billion to fund more testing for the pandemic.

Consolidated Appropriations Act, 2021

The Consolidated Appropriations Act, enacted on December 27, 2020, included $868 billion of federal support to help mitigate the economic impact of the COVID-19 pandemic.

Here are the components of that relief package:

- Aid to small businesses ($302 billion). The CARES Act created the Paycheck Protection Program (PPP), which provided loans to small businesses that were impacted by the broad economic shutdowns that were meant to mitigate the spread of the pandemic. This package allowed small businesses to receive a second round of PPP loans and ensured that such assistance was not be taxed. This category also includes Economic Injury Disaster Loan advances and emergency grants to entertainment venues.

- Direct payments to individuals ($164 billion). Individuals making up to $75,000 per year received a payment of $600, with an additional $600 for each dependent child. All payments phase out at higher incomes. (See how Americans spent the last round of stimulus checks.)

- Increased unemployment benefits ($119 billion). The earlier relief legislation provided several enhancements to unemployment insurance benefits that were ultimately allowed to expire. This package restored those enhancements, albeit at more modest levels. It added $300 per week to unemployment benefits, continued “gig” worker eligibility for unemployment benefits, and lengthened the maximum period that a worker could collect unemployment to 50 weeks.

- Aid for schools ($82 billion). About two-thirds of the total amount was for grants to public K-12 schools, and most of the remainder was for grants to higher education.

- Health-specific measures ($78 billion). Included in this category is $29 billion designated for the procurement and distribution of coronavirus vaccines and treatments and $22 billion for testing, tracing, and mitigation of coronavirus. An additional $14 billion supported healthcare providers and bolstered mental health services, and the National Institutes of Health received $1 billion to engage in further coronavirus research.

- Other measures ($123 billion). The legislation also included funding for transportation, increased food stamp benefits, additional childcare assistance, rental assistance, and other programs.

Photo by Joel Carillet/Getty Images

Further Reading

Here’s How No Tax on Overtime Would Affect Federal Revenues and Tax Fairness

Excluding overtime pay from federal taxes would meaningfully worsen the fiscal outlook, while most of the tax benefits would go to the top 20% of taxpayers.

No Taxes on Tips Would Drive Deficits Higher

Eliminating taxes on tips would increase deficits by at least $100 billion over 10 years. It could also could turn out to be a bad deal for many workers.

Full Array of Republican Tax Cuts Could Add $9 Trillion to the National Debt

Fully extending the TCJA would cost approximately $5.0 trillion, while other elements of the Republican tax agenda also have large price tags over ten years.