Yesterday the nonpartisan Congressional Budget Office released the 2017 Long-Term Budget Outlook, highlighting the significant fiscal challenges facing our nation.

Here are four key takeaways from our analysis of the CBO report:

1. Federal debt is already at its highest level since 1950 and is projected to climb to 150 percent of GDP under current law by 2047 — by far an all-time high.

2. Rising debt is a result of a structural imbalance between revenues and spending. Under current law, spending growth, which is fueled primarily by the aging of the population and growing healthcare costs, significantly outpaces the projected growth in revenues.

3. As the debt grows and interest rates rise, interest costs are projected to increase rapidly. By 2028, interest will become the third largest category of the budget, behind only Social Security and Medicare.

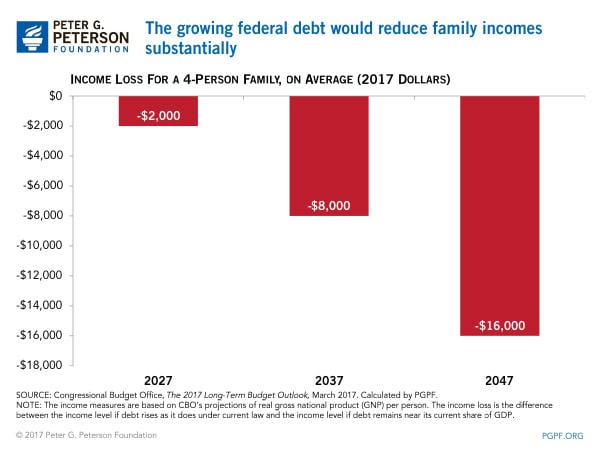

4. Rising debt will harm our economy and slow the growth of productivity and wages. On our current path, the annual average income loss for a 4-person family would be $16,000 by 2047.

The good news is that it’s not too late to adjust course, and the sooner we get started, the easier it will be to fix. To learn more about bipartisan policy options, visit our Solutions page.

Image credit: Photo by Chip Somodevilla/Getty Images

Further Reading

What Is the National Debt Costing Us?

Programs that millions of Americans depend on and care about may be feeling a squeeze from interest costs on our high and rising national debt.

Interest Costs on the National Debt Are Reaching All-Time Highs

The most recent CBO projections confirm once again that America’s fiscal outlook is on an unsustainable path — increasingly driven by higher interest costs.

New Report: National Debt Outlook Gets Worse as Interest Costs Exceed $1 Trillion Annually

A new CBO report shows that the national debt outlook worsened from last year’s projections.