Today, the nonpartisan Congressional Budget Office (CBO) released its 2019 Long-Term Budget Outlook, highlighting the significant fiscal challenges facing our nation.

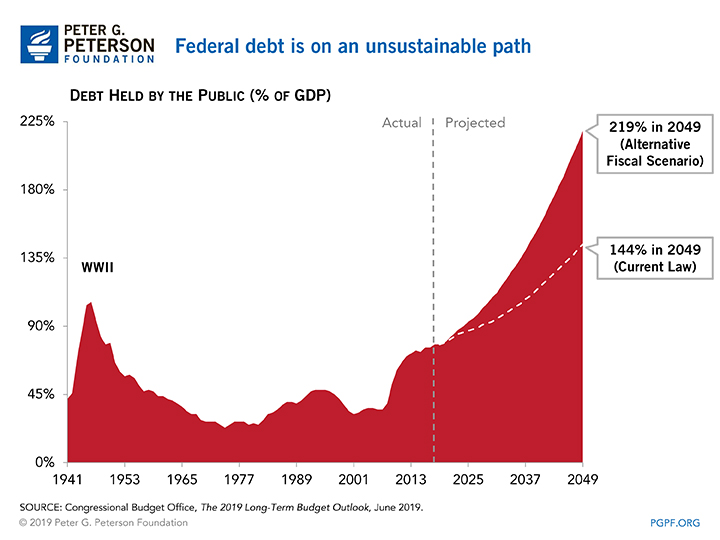

1) Debt is historically high — and rising. Federal debt is already at its highest level since 1950 and under current law is projected to climb to 144 percent of gross domestic product (GDP) by 2049 — by far an all-time high. However, if lawmakers extend certain costly policies, debt would rise even higher — to 219 percent of GDP — in 30 years.

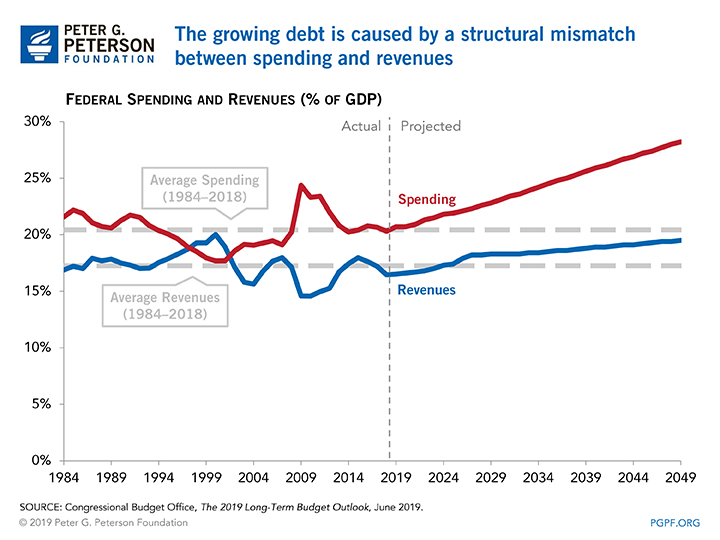

2) There’s a mismatch between revenue and spending. Rising debt is the result of a structural imbalance between revenues and spending. Under current law, spending growth, which is fueled primarily by the aging of the population, rising healthcare costs, and mounting interest payments, will significantly outpace the projected growth in revenues.

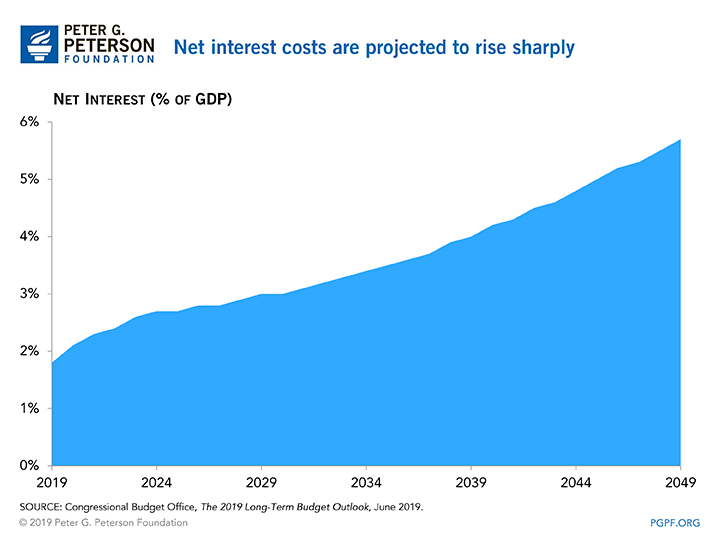

3) Interest costs are projected to triple. As the debt grows, the cost of paying interest on the debt is projected to increase rapidly. Such payments are projected to more than triple relative to the size of the economy, growing from 1.8 percent of GDP in 2019 to 5.7 percent in 2049.

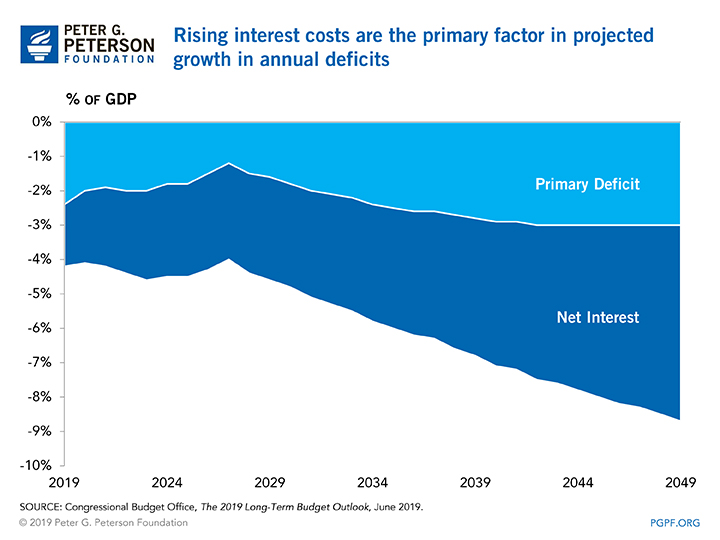

4) Interest is a key driver of deficits. The rapid rise in interest costs will propel substantial growth in future deficits. In fact, starting in 2020, net interest will exceed the primary deficit — and stay that way indefinitely.

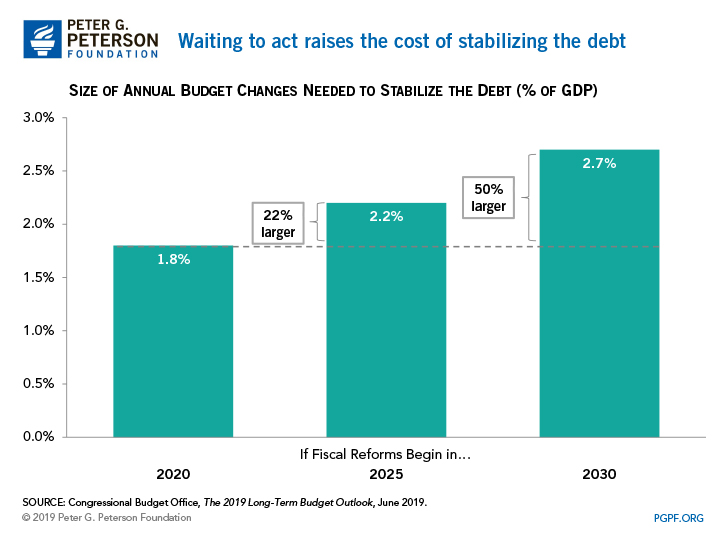

5) Acting sooner is better. The longer policymakers wait to address this challenge, the bigger the changes will have to be.

The good news is that it’s not too late to adjust course. Learn more about the Solutions Initiative, in which seven think tanks from across the political spectrum each put forward comprehensive budgets to significantly reduce our national debt.

Image credit: Photo by Alex Wong/Getty Images

Further Reading

Long-Term Budget Outlook Leaves No Room for Costly Legislation

As lawmakers consider costly legislation to extend expiring tax provisions this year, CBO’s latest projections serve as a warning that our fiscal outlook is already dangerously unsustainable.

Moody’s Warns Recent Policy Decisions Worsen U.S. Fiscal State, Maintains Negative Outlook Rating

Moody’s says that the United States is in fiscal deterioration, warning that government policy decisions in the near term could contribute to higher interest rates and worsening national debt.

National Debt Would Skyrocket Under TCJA Extension

New analysis released from the nonpartisan CBO shows deficits doubling and debt skyrocketing under a scenario where the expiring provisions of the Tax Cuts and Jobs Act were made permanent.