Lawmakers unveiled a tax overhaul framework today, outlining a number of changes to individual and corporate taxes. Below are charts that focus specifically on our corporate tax system.

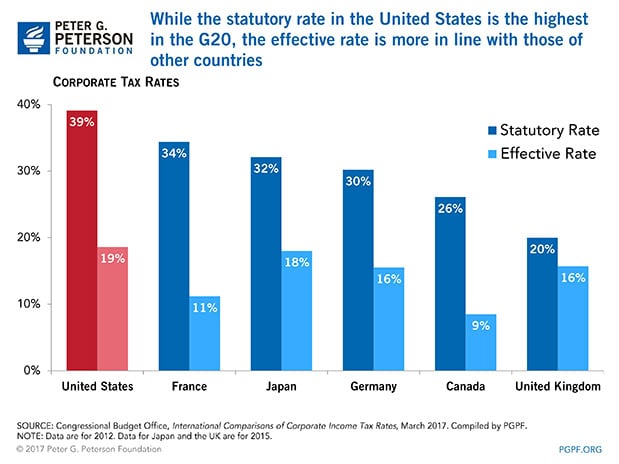

1. The United States has the highest total statutory corporate tax rate among G20 countries at 39.1 percent — 5 percentage points above that of France. That tax rate includes the federal tax on corporate income (35 percent) as well as taxes imposed at the state and local levels. However, the U.S. tax code has many preferences that affect the rate actually paid by corporations. The effective tax rate takes those preferences into account and yields a tax rate of 19%, which is more in line with other developed nations.

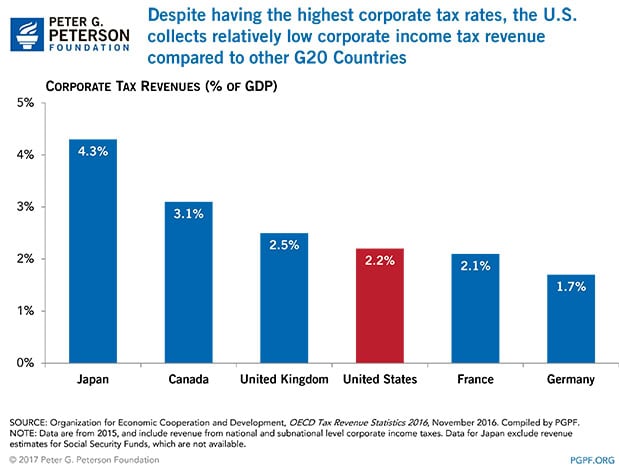

2. The United States collects less revenue from corporations as a share of GDP than many other advanced countries do. In 2015, the latest year for which data is available for international comparison, United States corporate tax revenues accounted for only about 2.2 percent of gross domestic product (GDP).

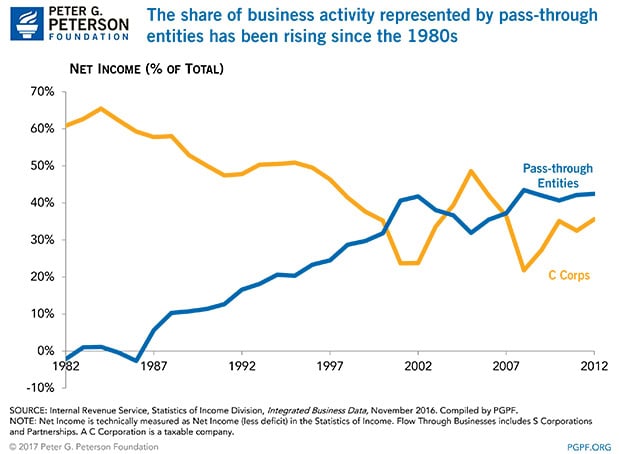

3. Not all businesses pay corporate taxes. Some businesses, known as pass-through entities, pass profits to their owners and are taxed under the individual income tax code. In fact, the share of income from pass-through entities has been rising since the 1980s.

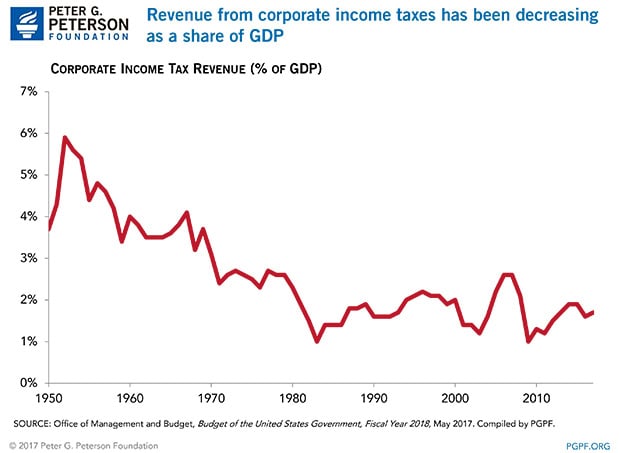

4. Revenues from corporate taxes have generally been declining as a share of GDP, in part as a result of the increase in pass-through businesses described above.

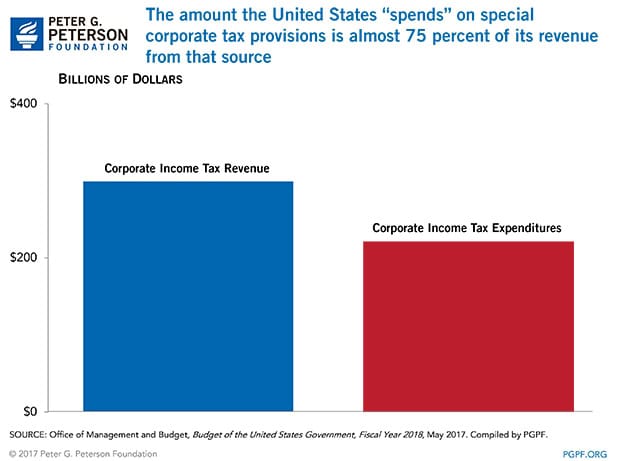

5. The United States forgoes nearly as much revenue as a result of tax expenditures for corporations as it collects in taxes from that source.

Photo by Getty Images

Further Reading

How Did the One Big Beautiful Bill Act Change Tax Policy?

See how OBBBA restructured the tax landscape across four major areas: individual tax provisions, business tax provisions, energy tax credits, and health-related tax changes.

Six Charts That Show Why Corporate Tax Revenues are Low in the U.S. Right Now

Compared to historical trends and other advanced economies, corporate tax revenues in the United States are low.

The U.S. Corporate Tax System Explained

Revenues raised by the corporate income tax represent the third-largest category of federal revenues in the United States.