“Even Under Optimistic Economic Scenarios, Debt Will Soon Reach Levels Well Above Historical Experience,” Economist Warns

Karen Dynan, former Assistant Secretary of the Treasury for Economic Policy and current professor at Harvard Kennedy School, recently joined several other prominent economists warning about the nation’s unsustainable fiscal outlook. In a chapter published in the Aspen Institute’s book, Building a More Resilient US Economy, Dynan explores the implications of the federal debt burden and the degree of change required to stabilize the national debt.

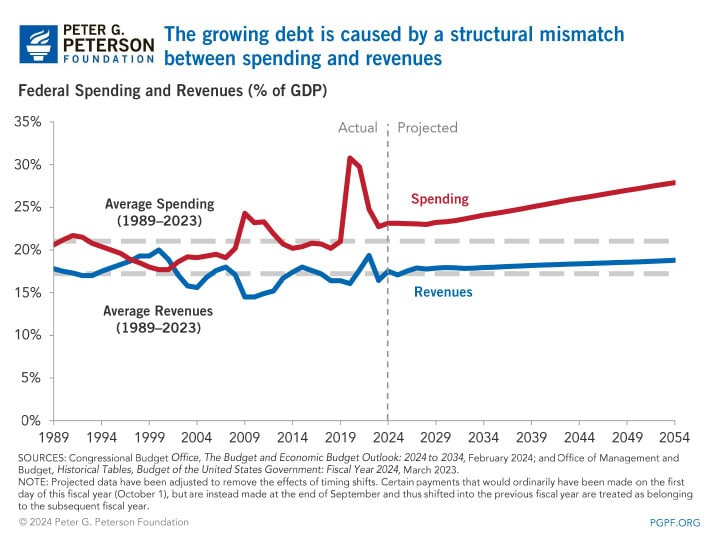

The national debt has grown dramatically over the past two decades, rising from 35 percent of gross domestic product (GDP) in 2003 to 97 percent in 2023. The increasing debt is due to a structural imbalance between federal spending and revenues. Dynan specifies three categories that will continue to exacerbate spending growth: an aging U.S. population, rising healthcare spending, and increasing interest payments. She also observes that economic factors, such as the Great Recession and the federal response to the COVID-19 pandemic, have further increased spending, while revenues are not growing at the same rate and have been reduced through legislation. Without reform, the structural mismatch between spending and revenues is projected to drive federal borrowing even higher in the coming decades, reaching 172 percent of GDP by 2054, according to the Congressional Budget Office.

Dynan notes three potential consequences of maintaining high debt levels:

- Crowding out of investment by the private sector, thereby stunting economic growth and national income.

- An increased risk of a fiscal crisis, which could occur if investors lose confidence in the nation’s fiscal position or the government’s ability to repay its debt — causing interest rates to climb or the value of the dollar to plunge.

- Less “fiscal space,” which refers to Congress’ ability to temporarily increase budget deficits to respond to domestic and international emergencies.

Dynan writes, “Even under optimistic economic scenarios, debt will soon reach levels well above historical experience, which will impose significant economic costs and risks.” She also states that less optimistic scenarios, “which are plausibly just as likely as the optimistic scenarios — will push federal debt to eye-popping levels even earlier."

Dynan’s warnings highlight our dangerous debt path. Fortunately, a number of solutions are available to address the nation’s unsustainable fiscal trajectory. To avoid the economic peril caused by rising debt, lawmakers should work together to put our nation on a stronger, more sustainable path.

Image credit: Photo by Jemal Countess/Getty Images for the Peter G. Peterson Foundation

Further Reading

The Fed Reduced the Short-Term Rate Again, but Interest Costs Remain High

High interest rates on U.S. Treasury securities increase the federal government’s borrowing costs.

What Types of Securities Does the Treasury Issue?

Learn about the different types of Treasury securities issued to the public as well as trends in interest rates and maturity terms.

Quarterly Treasury Refunding Statement: Borrowing Up Year Over Year

Key highlights from the most recent Quarterly Refunding include an increase in anticipated borrowing of $158 billion compared to the same period in the previous year.