Do Budget Caps Work? 6 Ways to Make Them More Effective

Last Updated October 18, 2023

Earlier this year, the Fiscal Responsibility Act (FRA) reinstituted caps on discretionary spending for fiscal years 2024 and 2025 to reduce federal outlays. Lawmakers have previously implemented various forms of caps to restrain spending and such efforts have been effective at times. A recent report from Brian Riedl of the Manhattan Institute, A Blueprint for Sustainable Discretionary Spending Caps, analyzes the effectiveness of past caps and how lawmakers might better utilize the budgeting tool in the future.

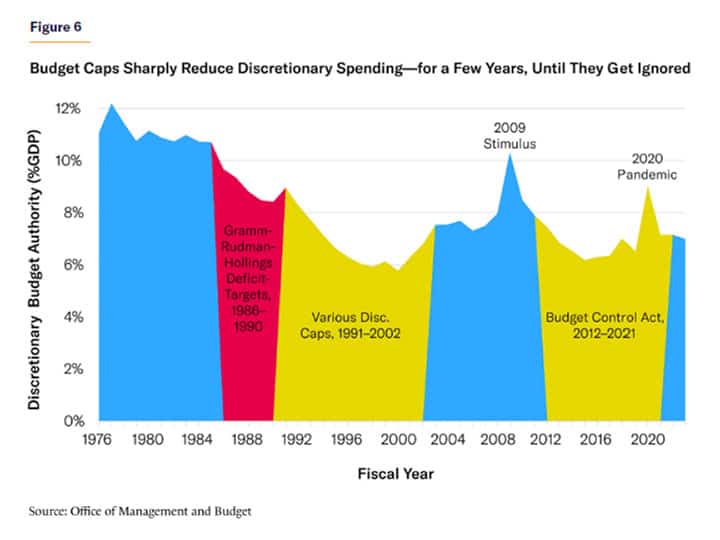

Limits on discretionary spending were first established in 1990 by the Budget Enforcement Act. That legislation established caps for defense, international, and domestic spending (later recategorized as just defense and nondefense spending) and called for an enforcement mechanism known as sequestration to bring total funding back to the cap levels if a limit was exceeded. The limits were initially set to expire in 1995 but were extended and redefined twice; in all, the first round of spending caps spanned 1991 to 2002. The next nine years had no budget caps in place, but as deficits widened, lawmakers enacted budget caps once again in the Budget Control Act of 2011. That act implemented caps from 2012 to 2021; it also contained a provision for automatic reductions in spending (mostly discretionary) if lawmakers failed to come up with a plan to reduce the deficit. Discretionary spending had no caps in place for 2022 and 2023, but the FRA outlined the reinstatement of caps at $1.59 trillion for fiscal year 2024 and $1.61 trillion for fiscal year 2025.

Riedl concludes that spending caps can be a good tool for budget control, but they are better under certain circumstances. Overall, budget caps were able to slow discretionary spending. From 1980 to 2023, years without caps saw discretionary spending grow at an average annual rate of 6.4 percent compared to 2.7 percent for years with caps.

In particular, realistic targets for discretionary spending were more likely to contribute to successful restraint in spending. Overly ambitious discretionary spending caps, such as the ones spanning 2012 to 2021, ultimately backfired because Congress eventually appropriated amounts well above the caps and passed large amounts of emergency spending in almost every year during that time period. Nevertheless, the caps from those years helped discretionary outlays come in $855 billion (in real terms) below the baseline at the beginning of the period. However, the more modest caps spanning the 1991-2002 period generated a reduction of $1.5 trillion (in today’s dollars). Those earlier caps were more successful because they were better able to accommodate underlying pressures for growth in appropriations.

After analyzing the caps from both time periods, Riedl presents approaches to discretionary caps to make them as effective as possible:

- Require legislative renewal every three to five years to reflect current political and economic realities.

- Allow automatic cap adjustments for significant inflation, scoring reestimates, and allowances.

- Include limits on defense and nondefense categories.

- Enforce cap levels better through a point of order against legislation that appropriates above spending caps.

- Ban Changes in Mandatory Programs (ChiMPs) that allow lawmakers to cut mandatory spending and then apply those savings to additional discretionary programs.

- Address emergency spending better by codifying a definition and requiring a simple majority vote for annual disaster relief.

Though discretionary spending is not the leading driver of the federal debt, it is typically the area of the federal budget that Congress looks to for deficit reduction. To help improve the effectiveness of budget caps in the future, Riedl recommends short- or medium-term time horizons, the ability to adjust to economic conditions, and a meaningful, but achievable level of savings.

Image credit: Photo by Samuel Corum/Getty Images

Further Reading

How Much Can DOGE Really Save by Cutting Down on Improper Payments?

Cutting down on improper payments could increase program efficiency, bolster Americans’ confidence in their government, and safeguard taxpayer dollars.

Continuing Resolutions Are Stopgap Measures — But Now We Average Five a Year

While continuing resolutions can help avoid government shutdowns, they should be rarely used. However, CRs have become the norm.

What Is a Continuing Resolution?

A continuing resolution is a temporary funding measure that Congress can use to fund the federal government for a limited amount of time.