Deficits Much Larger Than Projected Just Three Months Ago

Last Updated August 21, 2019

Today, the nonpartisan Congressional Budget Office (CBO) released an update to its 10-year projections, highlighting the negative impact that recent budget legislation has had on the fiscal challenges facing the country.

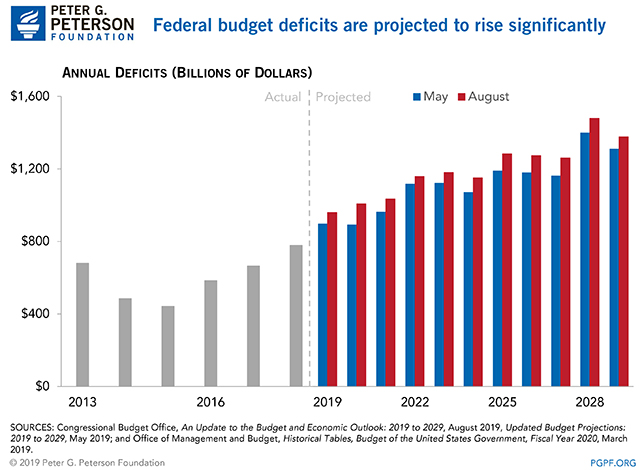

CBO Projects Larger Federal Deficits Than Previously Estimated

CBO projects that the deficit for 2019 will be $960 billion. That’s $63 billion (or 7 percent) above its estimate from just three months ago. Over the 2020–2029 period, projected annual deficits equal $12.2 trillion, or $0.8 trillion more than projected in May. That rise in projected deficits stems mostly from the Bipartisan Budget Act of 2019, although such increases in spending are partially offset by a reduction in anticipated interest rates — and therefore on interest payments — over the next decade.

In CBO’s projections, the deficit will exceed $1 trillion next year and continue growing in the future. CBO projects that deficits will average $1.2 trillion between 2020 and 2029, or 4.7 percent of gross domestic product (GDP). Such large deficits would be unusual during a period of economic expansion, and would limit the government’s ability to respond to future economic downturns.

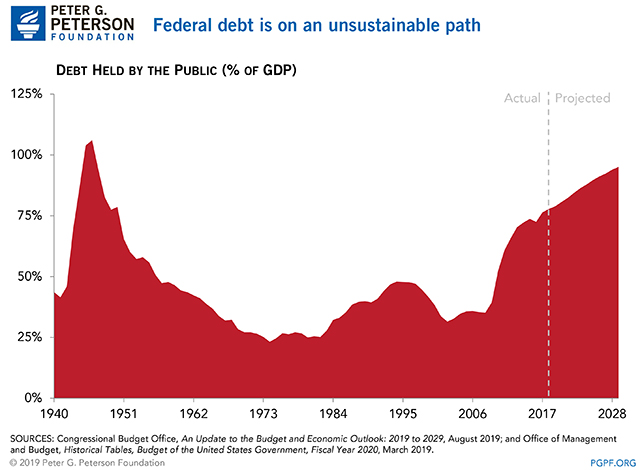

The National Debt Will Rise to Nearly Unprecedented Levels

As a result of growing deficits, the outlook for the national debt is worsening. In 2018, debt held by the public reached 78 percent of GDP. By 2029, CBO projects that the debt will grow to 95 percent of GDP — its highest level since immediately after World War II.

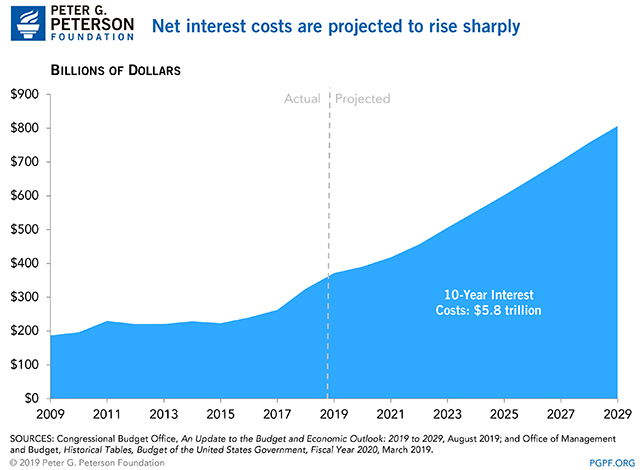

Interest Costs Still Expected to Rise Rapidly

Although CBO lowered its forecast for interest rates on Treasury securities, interest costs on the debt will still mount in the future. Such payments are projected to more than double from 2019 to 2029, rising from $372 billion this year to $807 billion in 2029.

Conclusion

Today’s report shows us that our leaders are making an already bad fiscal outlook considerably worse by enacting irresponsible legislation when we already face significant structural headwinds. Given the recent strength of the economy, policymakers have a valuable opportunity to improve our fiscal situation by reducing the annual deficit and, in turn, help our nation and economy prepare for the next downturn.

Image credit: Photo by Win McNamee/Getty Images

Further Reading

Long-Term Budget Outlook Leaves No Room for Costly Legislation

As lawmakers consider costly legislation to extend expiring tax provisions this year, CBO’s latest projections serve as a warning that our fiscal outlook is already dangerously unsustainable.

Moody’s Warns Recent Policy Decisions Worsen U.S. Fiscal State, Maintains Negative Outlook Rating

Moody’s says that the United States is in fiscal deterioration, warning that government policy decisions in the near term could contribute to higher interest rates and worsening national debt.

National Debt Would Skyrocket Under TCJA Extension

New analysis released from the nonpartisan CBO shows deficits doubling and debt skyrocketing under a scenario where the expiring provisions of the Tax Cuts and Jobs Act were made permanent.