While lawmakers of both parties agree that the budget process needs updating, there has been little agreement as to how to fix it. The recent creation of the Joint Select Committee on Budget and Appropriations Process Reform is therefore a welcome opportunity for lawmakers to improve the process in a way that will encourage fiscally responsible policymaking.

One of the issues that will likely be discussed are caps on appropriations (also known as “discretionary caps”). Currently, there are separate limits on the amount of funding that can be provided for defense and nondefense purposes through the appropriation process. Here’s some background on the origin and recent history of those caps.

The Origin of Budget Caps

In 1990, the Budget Enforcement Act (BEA) first established caps on discretionary spending (and also created enforcement mechanisms on other components of the budget) to help restrain appropriations and reduce the budget deficit. The caps set out in the BEA covered three categories: defense, international, and domestic spending. If the limits on any of those categories were exceeded, the BEA provided an enforcement mechanism, known as sequestration, to cancel resources and bring total funding back to the cap levels. The caps were initially set to expire in 1995, but were extended and redefined in 1993 and 1997. However, the late 1990s represented a time of economic growth and budget surpluses, and interest in enforcing the caps waned. The caps were allowed to expire in 2002, even though budget deficits had returned by that year.

The Budget Control Act and the Reinstatement of the Caps

In summer 2011, the United States was nearing the debt limit, or the point after which the U.S. Treasury would no longer be able to continue paying all of the government’s obligations. Increasing the debt limit is a common occurrence — it has been raised 86 times since 1959. In some cases, an increase in the debt limit has been associated with legislation intended to reduce the deficit; in 2011, that approach was taken with the enactment of the Budget Control Act of 2011 (BCA).

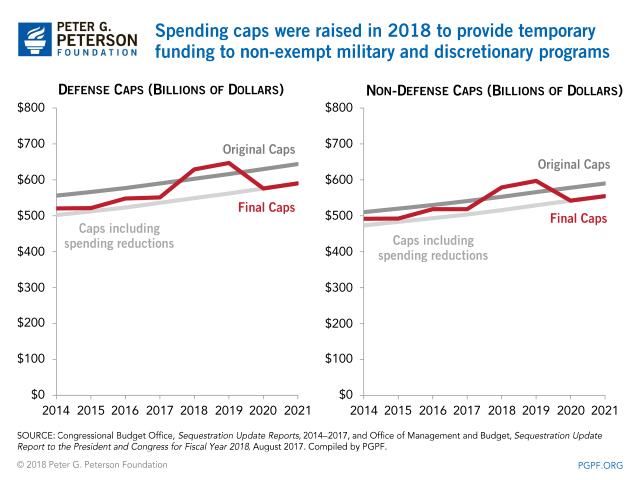

The BCA included caps on discretionary programs from 2011–2021. The act also established a committee to develop a proposal that would reduce the deficit by $1.5 trillion over a 10-year period. When that committee failed to come up with a plan, the BCA’s contingency for deficit reduction went into effect, creating automatic spending reductions of $1.2 trillion over that same period. Most of those automatic spending reductions were applied to defense and nondefense discretionary programs, thereby reducing the limits on appropriations below the amounts set in the BCA.

Not all discretionary programs are constrained by the caps. The exempted programs include:

- Overseas Contingency Operations, which consists mainly of funding for activities in Afghanistan and similar missions

- Disaster relief and emergency requirements, which are primarily used to respond to natural disasters

- Program integrity initiatives, which are intended to reduce overpayments in benefit programs

Subsequent Legislation and Current Limits

In 2013, 2015, and again in 2018, Congress and the President enacted legislation to raise the caps. Without the most recent agreement on raising the caps put in place by the BCA, caps of $549 billion on non-exempt military spending and $516 billion on non-defense discretionary spending would have been applied in 2018. Instead, defense discretionary caps were raised by $80 billion for 2018 and $85 billion for 2019 while non-defense discretionary caps were raised by $63 billion and $68 billion, respectively.

In 2020, lawmakers will again be faced with a significant reduction in in the funds available for programs that are subject to the caps. Though the latest increases in the caps have provided funding that many felt was necessary, they also underline the tenuous nature of fiscal restraints currently in place and the weakness of existing enforcement measures.

Photo by Stefani Reynolds/Getty Images

Further Reading

What Is the Farm Bill, and Why Does It Matter for the Federal Budget?

The Farm Bill provides an opportunity for policymakers to comprehensively address agricultural, food, conservation, and other issues.

How Much Is the National Debt? What Are the Different Measures Used?

There are three widely used measures of federal debt. What are the important differences between these measurements?

What Is the Primary Deficit?

The primary deficit is the difference between government revenues and spending, excluding interest payments. Learn more about the U.S. primary deficit.