Breaking Down the Coronavirus Relief Spending — How Much Direct Aid Has Gone out the Door So Far?

Last Updated July 13, 2020

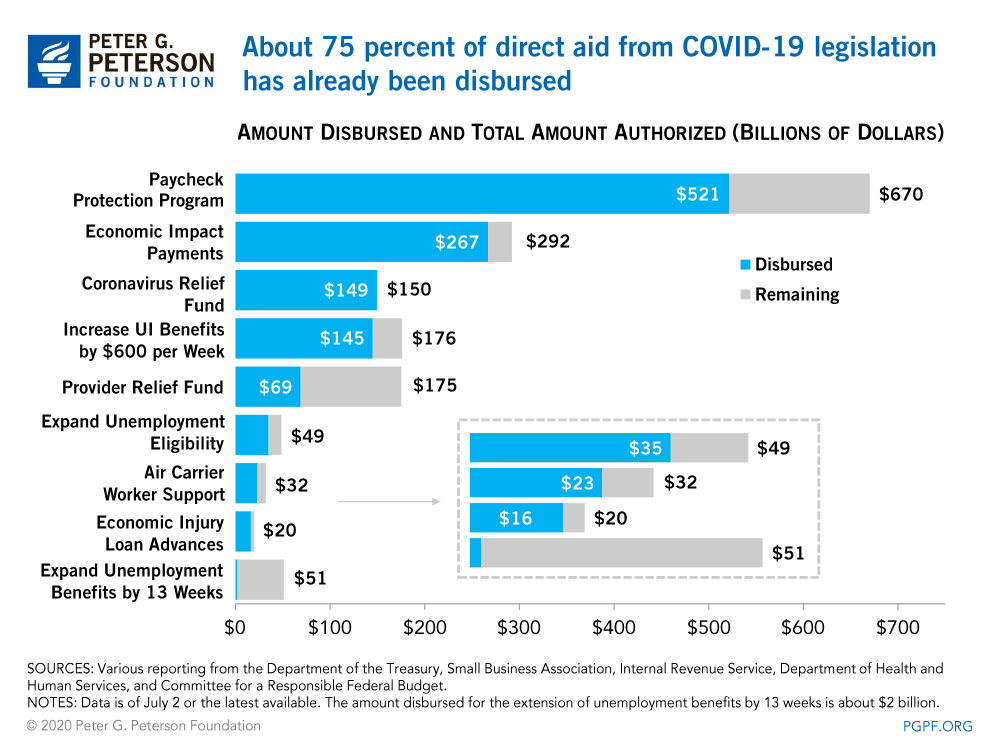

To date, policymakers have authorized an estimated $3.6 trillion in federal spending (the budgetary cost of which is only $2.4 trillion) to help counter the economic effects of the coronavirus (COVID-19) pandemic. Of that authorized spending, nearly 45 percent, or $1.6 trillion, is in the form of direct payments such as expanded unemployment benefits, forgivable business loans, and cash payments to taxpayers, healthcare providers, and governments. The remaining 55 percent is comprised of indirect payments, which includes items such as tax incentives and certain loans.

This blog breaks down the disbursement of the $1.6 trillion in direct aid, which includes $690 billion to businesses, $600 billion to individuals, and $325 billion to others such as healthcare providers and state and local governments. As of July 2, $1.23 trillion, or about 75 percent of those direct payments, have been disbursed.

Direct Relief for Businesses

Paycheck Protection Program. The Paycheck Protection Program (PPP) provides $670 billion worth of federally backed loans in an effort to incentivize small businesses to maintain their payroll during the crisis; those loans will be forgiven if used for certain expenses such as payroll, rent, or utilities. The Small Business Administration (SBA), the agency that administers the program, has disbursed $521 billion of such loans as of June 30. That amount does not necessarily include loan increases, loan decreases, or all of the $10 billion set aside for community development financial institutions. The deadline to apply for PPP funding has been extended to August 8, 2020.

Economic Injury Disaster Loan Advances. Economic Injury Disaster Loan (EIDL) Advances, also referred to as EIDL grants, provide up to $10,000 of economic relief to qualified small businesses and agricultural businesses that faced economic injury because of the pandemic; such advances do not have to be repaid. Taken together, the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the Paycheck Protection Program and Healthcare Enhancement Act authorized a total of $20 billion to the program. As of July 3, the SBA has disbursed about $16 billion in EIDL Advances.

Payments to Help Individuals

Economic Impact Payments. The Internal Revenue Service (IRS) is issuing direct payments, often referred to as stimulus checks and usually totaling $1,200 for individuals and $2,400 for married couples, to help Americans mitigate the economic impact of the COVID-19 pandemic. As of June 3, the IRS had processed 159 million payments, totaling almost $267 billion. The Joint Committee on Taxation estimates that those payments will cost a total of $292 billion through 2021.

Extension of Unemployment Benefits. The CARES Act extended unemployment benefits through three “programs”:

- Increasing Unemployment Benefits by $600 per Week. As part of the CARES Act, policymakers enacted the Federal Pandemic Unemployment Compensation program. Qualified individuals who receive certain unemployment benefits will receive an additional $600 per week, until July 31, 2020. That program has spent about $145 billion as of July 2, according to the Committee for a Responsible Federal Budget (CRFB), which is slightly over 80 percent of the Congressional Budget Office’s (CBO) estimated total cost of $176 billion.

- Expanding Unemployment Benefits by 13 Weeks. Another labor force program included in the CARES Act, the Pandemic Emergency Unemployment Compensation program provides up to 13 additional weeks of unemployment benefits to people who have exhausted their regular unemployment benefits. Qualified individuals can receive such benefits until the end of December 2020. CRFB estimates that the program has resulted in $2 billion in outlays as of July 2. Overall, the program is expect to cost $51 billion.

- Expanding Unemployment Eligibility. The Pandemic Unemployment Assistance program expands eligibility for unemployment benefits to people who are not usually eligible for regular unemployment compensation — such as self-employed workers, independent contractors, and individuals without sufficient work history. The program provides benefits for up to 39 weeks of unemployment beginning on or after January 27, 2020 and ending on or before December 31, 2020. The Department of Labor estimates that the program will cost nearly $49 billion; CRFB estimates about $35 billion of such spending has been disbursed as of July 2.

Air Carrier Worker Support. The Payroll Support to Air Carriers and Contractors program provides up to $32 billion in federal aid to maintain employment in the airline industry. While the money is provided to employers, it is used to cover employee wages, salaries, and benefits. The Treasury has disbursed $23 billion as of July 2, out of a total of $32 billion authorized for the program.

Assistance to Healthcare Providers and Governments

Provider Relief Fund. The $175 billion Provider Relief Fund, administered by the Department of Health and Human Services (HHS), distributes direct payments to hospitals and other healthcare providers on the front lines of the coronavirus response. The CARES Act authorized $100 billion to the fund — $50 billion is allocated proportional to providers’ share of revenues (known as general distribution) and another $50 billion is allocated for targeted distribution to healthcare providers in areas affected the most by the pandemic (known as targeted distribution). The Paycheck Protection Program and Healthcare Enhancement Act, the fourth coronavirus response legislation, allocated an additional $75 billion to the fund. HHS’s distribution timeline indicates that nearly $70 billion of the total funding has been disbursed thus far. However, the agency announced in June that they will be providing an additional $20 billion for general distribution, $15 billion to eligible Medicaid and CHIP providers, $10 billion to safety net hospitals, and $10 billion to hospitals in COVID-19 hotspots. The remaining funding has yet to be allocated.

Coronavirus Relief Fund. Such funding consists of $150 billion in direct federal aid to governments in states, territories, and tribal areas to cover expenditures incurred due to the COVID-19 pandemic. As of July 2, the Treasury has disbursed $149 billion of that aid.

Image credit: Getty Images

Further Reading

How Much Can the Administration Really Save by Cutting Down on Improper Payments?

Cutting down on improper payments could increase program efficiency, bolster Americans’ confidence in their government, and safeguard taxpayer dollars.

How Do Quantitative Easing and Tightening Affect the Federal Budget?

The Federal Reserve plays an important role in stabilizing the country’s economy.

Here’s How No Tax on Overtime Would Affect Federal Revenues and Tax Fairness

Excluding overtime pay from federal taxes would meaningfully worsen the fiscal outlook, while most of the tax benefits would go to the top 20% of taxpayers.