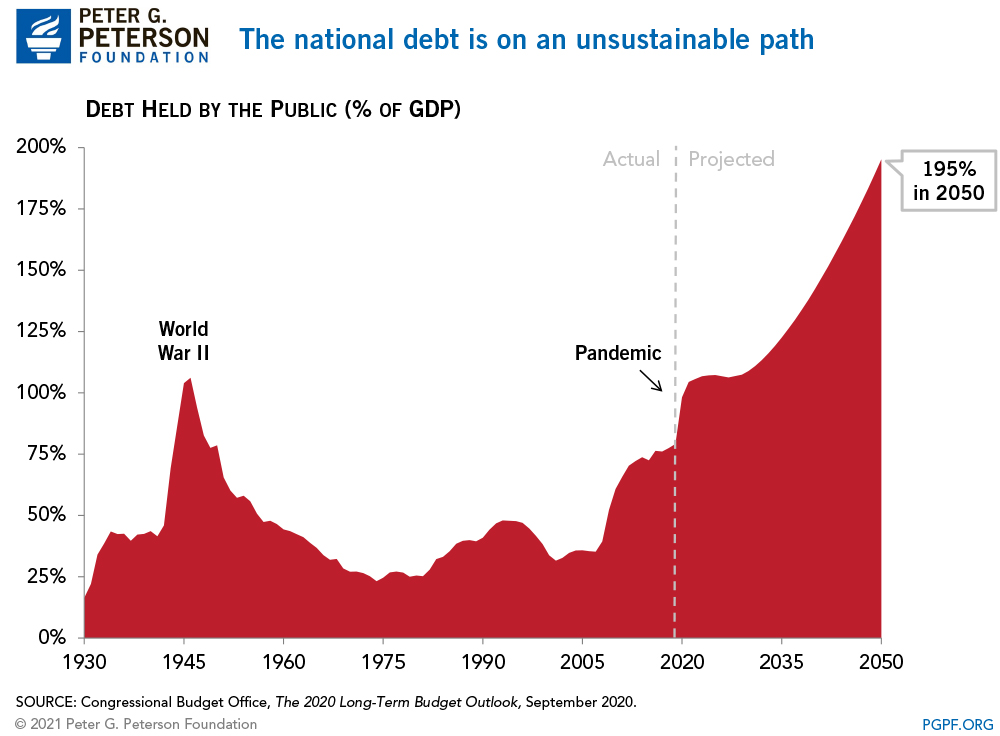

The federal debt rose to nearly the size of our entire economy in fiscal year 2020, almost 10 years earlier than previously projected. Undoubtedly, the coronavirus (COVID-19) pandemic and the federal response to it caused the large rise in the debt last year. However, we were on an unsustainable path to begin with, and once the pandemic is behind us our fiscal challenges will remain.

The good news is that there are many options available to policymakers to put our nation on a better path. Recently, the Congressional Budget Office (CBO) highlighted 83 ways to reduce the deficit and improve our fiscal outlook — including options to cut spending and raise revenues.

Solutions to Reduce the National Deficit

The CBO report includes options for both increasing revenues and reducing spending. Among the 31 proposals to boost revenues are:

- Changes to individual income tax rates. Increasing income tax rates for individuals by 1 percentage point for all brackets would increase tax collections by $884 billion over the next 10 years, according to CBO’s estimate. Raising individual income tax rates by 1 percentage point on only the highest four brackets would increase revenues by $203 billion over the same period. (See the current tax brackets.)

- Changes to the corporate income tax rate. Raising the corporate income tax rate by 1 percentage point would increase tax collections by $99 billion over the next 10 years.

- Taxation of greenhouse gas emissions. Imposing a tax of $25 dollars per metric ton of greenhouse gas emissions would raise revenues by $1 trillion between 2021 and 2030.

On the spending side of the budget, 52 options are presented, including:

- Changes to Medicare. The combined effect of the following changes to Medicare would reduce the deficit by $702 billion over the next 10 years: increasing the premiums that enrollees pay for Medicare Part B and Part D coverage while freezing income thresholds for income-related premiums; requiring drug manufacturers to pay a minimum rebate on drugs covered under Part D for low-income beneficiaries; and establishing uniform cost sharing for Medicare and restricting supplemental insurance policies.

- Changes to Social Security. Three adjustments to Social Security, taken together, would reduce the deficit by $217 billion over the next 10 years. Those changes are: calculating initial benefits of individuals who become newly eligible in 2022 based on average prices rather than average wages; making the benefit structure more progressive by increasing benefits for lower-income workers while reducing benefits for those with higher income; and raising the full retirement age from 67 to 70.

- Reductions in Defense Spending. Reducing the budget for the Department of Defense by 5 percent relative to the amount planned for 2024 would save $317 billion through 2030.

Lawmakers should use the options presented by CBO as a starting point for conversations about how to address the growing federal debt once the economy recovers from the pandemic. Our current fiscal situation deteriorated due to COVID-19 but is primarily the result of a fundamental mismatch between spending and revenues — and the CBO report includes options that address both, providing lawmakers with many possible paths for improving our fiscal outlook.

Image credit: Photo by Getty Images

Further Reading

Growing National Debt Sets Off Alarm Bells for U.S. Business Leaders

Debt rising unsustainably threatens the country’s economic future, and a number of business leaders have signaled their concern.

What Is R Versus G and Why Does It Matter for the National Debt?

The combination of higher debt levels and elevated interest rates have increased the cost of federal borrowing, prompting economists to consider the sustainability of our fiscal trajectory.

High Interest Rates Left Their Mark on the Budget

When rates increase, borrowing costs rise; unfortunately, for the fiscal bottom line, that dynamic has been playing out over the past few years.