On January 9, House Republicans adopted a new set of rules to govern how they will conduct legislative business for the 118th Congress. That package included “CUTGO,” a modified approach to the previous House PAYGO rule, both of which limit lawmakers’ discussion of legislation that would increase the deficit. So what’s the difference between PAYGO and CUTGO and how does it affect the budget?

What Is CUTGO in the House Rules?

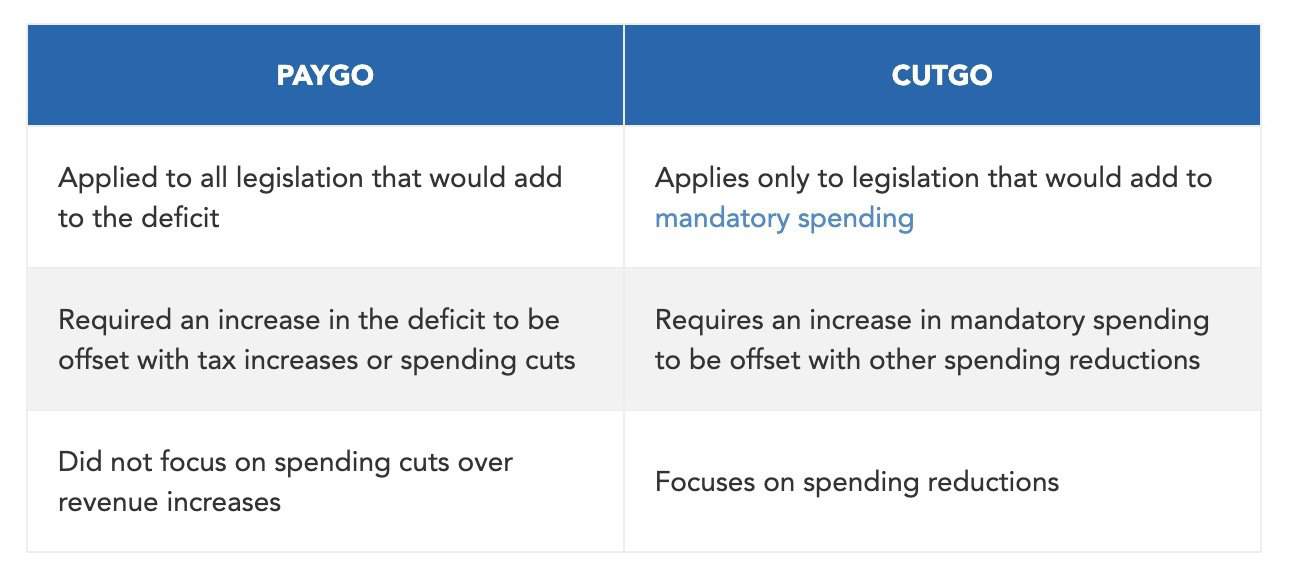

CUTGO is short for “cut-as-you-go,” and it is an internal rule used by the House of Representatives, meaning that it does not apply to consideration of legislation in the Senate. CUTGO prohibits consideration of legislation that would increase mandatory spending over the period covered by the budget. It is meant to restrain increases in spending from new legislation, ensuring that it will not add to the deficit. CUTGO has been used by the House before: Republicans in the 112th Congress replaced PAYGO with CUTGO in 2011; the rule remained in effect until 2019 when the Democrats gained majority of the House.

What Was PAYGO in the House Rules?

PAYGO was a similar rule, with one important difference. Whereas CUTGO only applies to spending that adds to the deficit, PAYGO applied to both sides of the ledger: either spending increases or revenue reductions that would add to the deficit.

Is Statutory PAYGO Still in Effect?

Yes. Statutory PAYGO is separate from House and Senate rules and remains in effect. Statutory PAYGO looks at new spending obligations and revenues over the course of each year using five- and 10-year scorecards and then requires cuts if there is a net debit.

How Does CUTGO Affect Fiscal Policy?

The Committee for a Responsible Federal Budget notes that while some parts of Congress’ package encourage legislation that lowers spending, overall the package “weaken[s] fiscal constraints and make[s] it easier to add to the debt.” The main concern for the federal budget is that CUTGO would not require offsets for legislation that reduce revenues so that certain legislation could still increase the deficit and comply with House rules.

Such actions occurred in the past. For example, the Tax Cuts Jobs Act was passed without offsets in 2017, when the CUTGO rule was in place. The Joint Committee on Taxation and the Congressional Budget Office (CBO) estimated that the legislation added $1.5 trillion to the 10-year deficit (between 2018 and 2027) through decreases in tax rates and other provisions. Reinstating the CUTGO rule leaves potential for extending parts of that act or passing additional legislation that would add to the debt.

Conclusion

Given the existing imbalance between spending and revenues and the unprecedented national debt, returning to the CUTGO rule offers easier opportunities to increase the deficit through tax cuts. Moving forward, Congress should prioritize rules that encourage fiscal responsibility on both sides of the ledger in order to support a balanced and durable approach to create a positive outlook for the United States.

Image credit: Win McNamee

Further Reading

How Much Can the Administration Really Save by Cutting Down on Improper Payments?

Cutting down on improper payments could increase program efficiency, bolster Americans’ confidence in their government, and safeguard taxpayer dollars.

How Do Quantitative Easing and Tightening Affect the Federal Budget?

The Federal Reserve plays an important role in stabilizing the country’s economy.

Can a Rescissions Package Help Lawmakers Formalize DOGE Cuts?

Rescission packages can serve as a tool for the President and Congress to manage and control government spending through a formal statutory process.