Investing in Kids Promotes Healthy Children, More Productive Adults, and a Stronger Fiscal Foundation

Last Updated January 25, 2024

Federal programs that invest in children are not only critical to the health and well-being of the youngest Americans, but they can also provide long-term benefits to the nation’s economy and fiscal trajectory, according to a recent study from the Kids’ Share project at the Urban Institute. Highlights from the study are summarized below. Over the long-term, investments can produce healthier, better supported childhoods, greater productivity in adulthood, increased tax revenues from a higher quality labor force, and reduced spending on criminal justice as well as healthcare for chronic diseases.

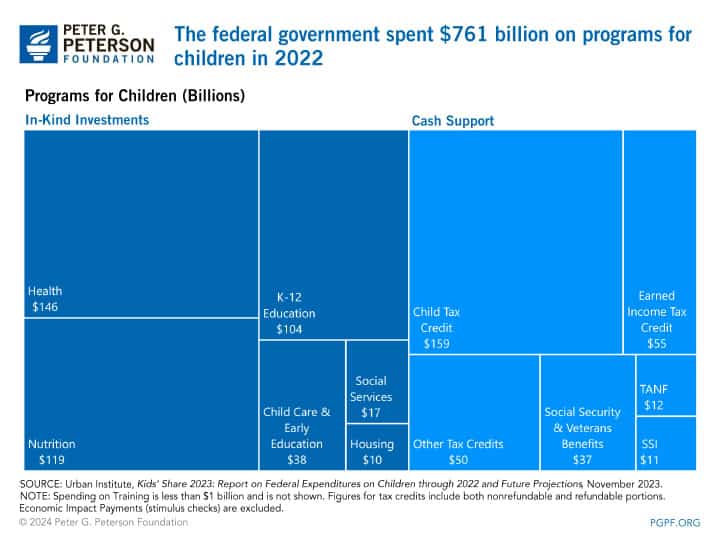

The Kids’ Share study considers federal spending an investment in children when children are the only beneficiaries from the program, a service is delivered directly to children, or benefits to families are determined by the number of dependent children. Generally, the study identifies two types of investments the federal government makes in children:

- Cash support is delivered to families through the tax system or other programs, giving families discretion to spend support to meet unique needs and can free up monies to relieve financial stress. Examples of cash support programs include the Child Tax Credit and the Earned Income Tax Credit, which are the largest of such programs.

- In-kind investments are programs that directly provide services or subsidize the purchase of goods and services for children; such programs often differ from cash supports because they restrict how families can spend benefits. Examples of those investments include Title I education grants to school districts to help deliver quality education in areas with a high concentration of low-income families and the Supplemental Nutrition Assistance Program (SNAP).

In 2022, the federal government invested $761 billion in children through cash support and in-kind investments.

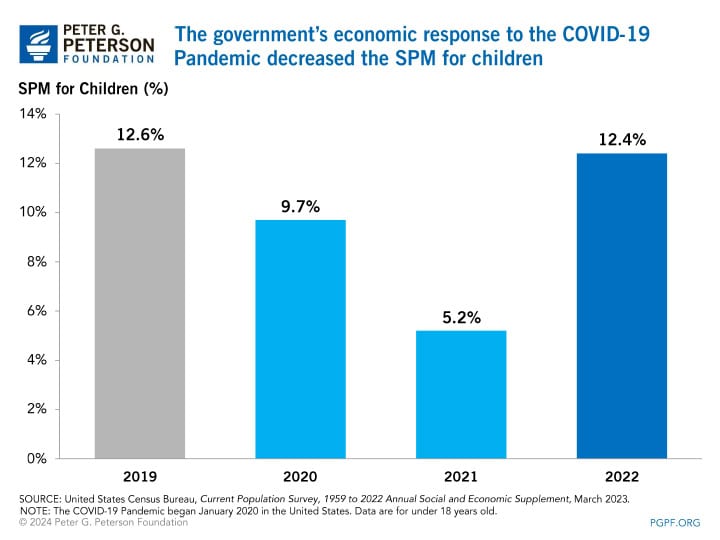

In the short term, investments in children lower poverty rates, support children’s development, and increase academic achievement. The short-term benefits of investments in children were exhibited when lawmakers expanded investments in children during the COVID-19 pandemic. Along with stimulus checks, pandemic relief enhanced the Earned Income and Child Tax Credits and increased SNAP benefits; those actions greatly contributed to a decline in the supplemental poverty measure (SPM) for children. In 2021, the SPM for children was nearly 60 percent lower than its pre-pandemic level. However, child poverty returned to around its pre-pandemic level when much of the relief spending expired in 2022.

Over the long term, investments in children produce healthier, more educated, and more productive adults. They also lead to savings in spending on criminal justice, healthcare, and social services for adults. Researchers Michael McLaughlin and Mark R. Rank quantified the economic costs of child poverty and found that, in 2015, child poverty cost a total of $1.3 trillion. One-third of that cost was attributable to increased crime and incarceration, followed by reduced earnings and increased healthcare costs. The Urban Institute notes that programs for health, child care and preschool, and K-12 education have the greatest economic payoff — with the associated increases in real future tax revenues from increased earnings offsetting the cost of the programs. In fact, a study published by the National Bureau of Economic Research suggests that for every dollar the federal government invests in programs that benefit children, societal returns can amount to $10 or more for some programs — a 10-fold return on investment.

Research shows that investing in children can produce positive returns in the short- and long-term, contributing to a healthy childhood and productive adulthood in addition to producing positive fiscal outcomes for the government. The government’s growing debt threatens to crowd out critical investments — like those in children — as the structural gap between spending and revenues widens and interest costs grow. Spending on children as a share of gross domestic product is projected to decrease by one-third a decade from now, while interest on the national debt will almost double. Adopting policies that restore the balance between spending and revenues can help ensure that the United States can invest in its priorities for the future, including in America’s children.

Image credit: Phillip Faraone/Getty Images

Further Reading

What Is the Farm Bill, and Why Does It Matter for the Federal Budget?

The Farm Bill provides an opportunity for policymakers to comprehensively address agricultural, food, conservation, and other issues.

Social Security Reform: Options to Raise Revenues

Here are the pros and cons for three approaches to increasing funds dedicated to Social Security.

Lawmakers are Running Out of Time to Fix Social Security

Without reform, the combined Social Security trust funds will be depleted in 2035.