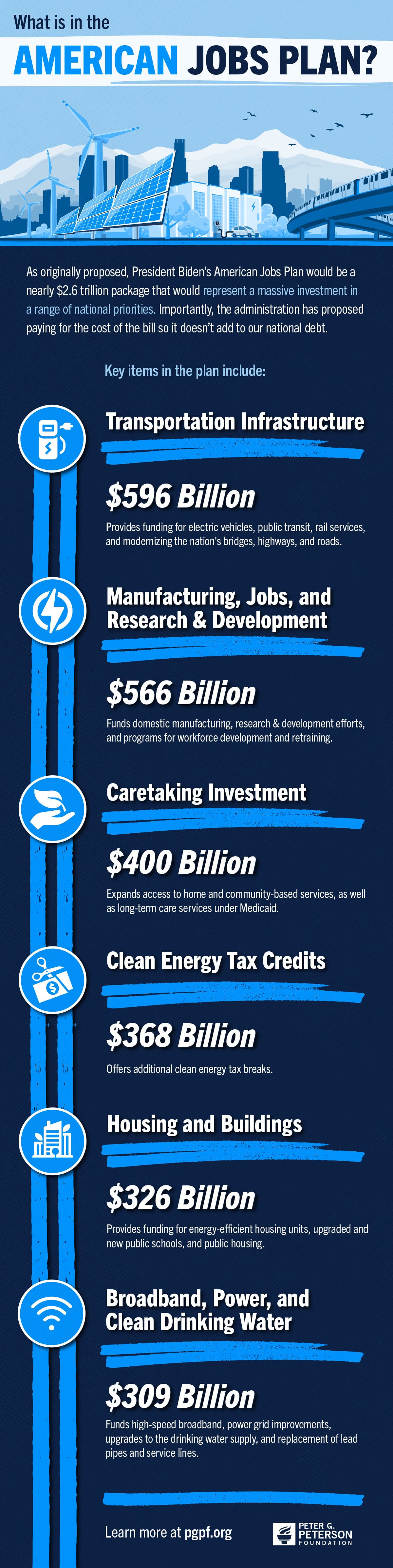

In May, the Administration released details for the proposed American Jobs Plan. It would be a massive investment in a range of national priorities including transportation, climate change, caregiving, and housing.

The Biden administration has proposed offsetting the spending in the $2.6 trillion package through changes to the corporate tax code, including an increase in the corporate tax rate.

The proposed spending in the American Jobs Plan covers a 10-year window and is broken down in the following ways.

Feel free to share this infographic on Twitter.

Further Reading

Full Array of Republican Tax Cuts Could Add $9 Trillion to the National Debt

Fully extending the TCJA would cost approximately $5.0 trillion, while other elements of the Republican tax agenda also have large price tags over ten years.

Why Do Budget Baselines Matter?

Applying the current-policy baseline would not only be fiscally irresponsible in terms of this year’s tax debate, but it would set a dangerous precedent for the future.

Social Security Reform: Options to Raise Revenues

Here are the pros and cons for three approaches to increasing funds dedicated to Social Security.