The Federal Reserve Will Begin Reducing Its Holdings of Treasury Notes and Bonds

Last Updated June 15, 2022

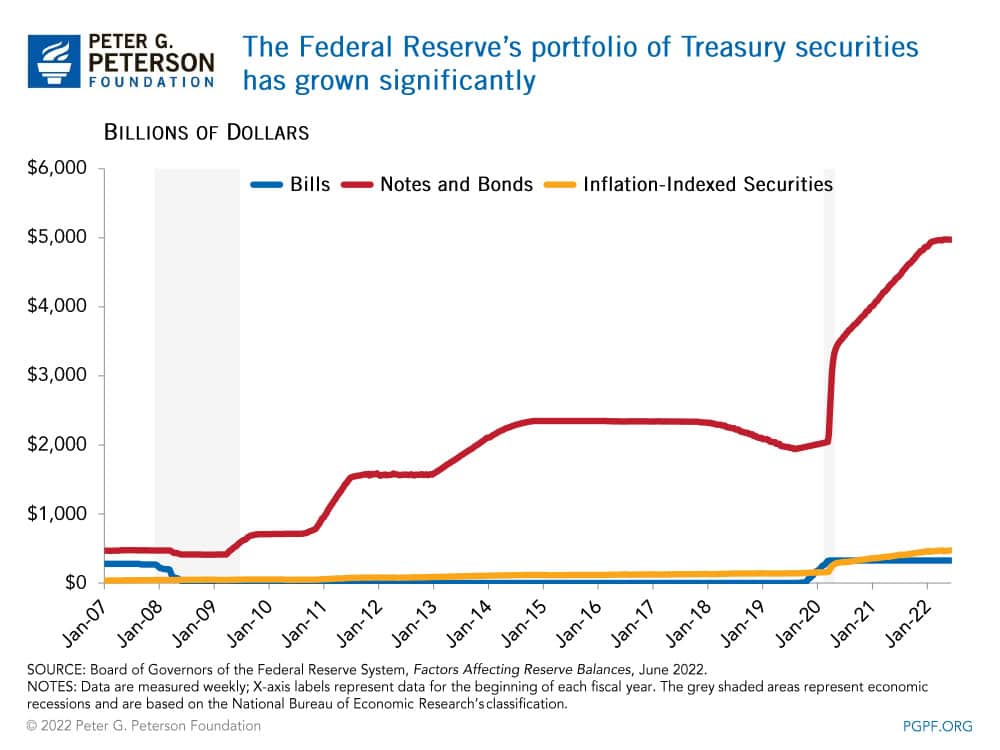

Since the coronavirus (COVID-19) pandemic began, the U.S. Federal Reserve has significantly ramped up its holdings of Treasury securities as part of a broader effort to counteract the economic impact of the public health emergency. Currently, the Federal Reserve holds more Treasury notes and bonds than ever before. However, the Fed recently announced it will begin reducing the size of its balance sheet this month to combat high inflation and a tight labor market.

As of June 8, 2022, the Federal Reserve has a portfolio totaling $8.97 trillion in assets, an increase of $4.25 trillion since March 18, 2020 (around the time that many businesses shut down). Longer-term Treasury notes and bonds (excluding inflation-indexed securities) comprise two-thirds of that expansion, with holdings of those two types of securities more than doubling from $2.15 trillion on March 18, 2020 to $4.97 trillion on June 8, 2022.

y comparison, the Federal Reserve only increased its holdings of Treasury notes and bonds by $116 billion, or roughly 25 percent, between December 5, 2007 and June 24, 2009 (a period known as the Great Recession). Over that same period, the Federal Reserve expanded its total portfolio from $920 billion in December 2007 to $2.1 trillion in June 2009, a total increase of $1.2 trillion. Much of that increase stemmed from the purchase of mortgage-backed securities and the implementation of new programs to address the economic slowdown.

The Federal Reserve’s purchases of longer-term Treasury securities over the past two years was part of their effort to support the economy through quantitative easing. Those purchases injected money into the economy to reduce longer-term interest rates and therefore encourage lending and investment. Such efforts by the Federal Reserve helped mitigate the economic fallout from the pandemic along with spending on safety net programs such as unemployment compensation and other programs created to provide aid to sectors of the economy hit hardest by the pandemic.

On June 1, 2022, the Federal Reserve initiated the process of reducing the size of its balance sheet to address rising inflation. According to a May press release, the Fed will initially cap its monthly purchase of Treasury securities at $30 billion for June, July and August – for context, the Federal Reserve purchased an average of $80 billion in Treasury securities per month between March 2020 and March 2022. The cap is set to increase to $60 billion in September and will likely remain at that level through the end of calendar year 2023. The Federal Reserve will also reduce its holdings of mortgage-backed securities over the coming months.

Image credit: Photo by Mark Wilson/Getty Images

Further Reading

National Debt Puts Upward Pressure on Inflation and Interest Rates

America’s unsustainable fiscal outlook can have “significant consequences for price stability, interest rates, and overall economic performance,” according to a new report.

Why Is the Federal Deficit High If Unemployment Is Low?

The U.S. is experiencing an unusual and concerning phenomenon — the annual deficit is high even though the unemployment rate is low.

What Is Inflation and Why Does It Matter?

Here’s an overview of inflation, why it matters, and how it’s managed.