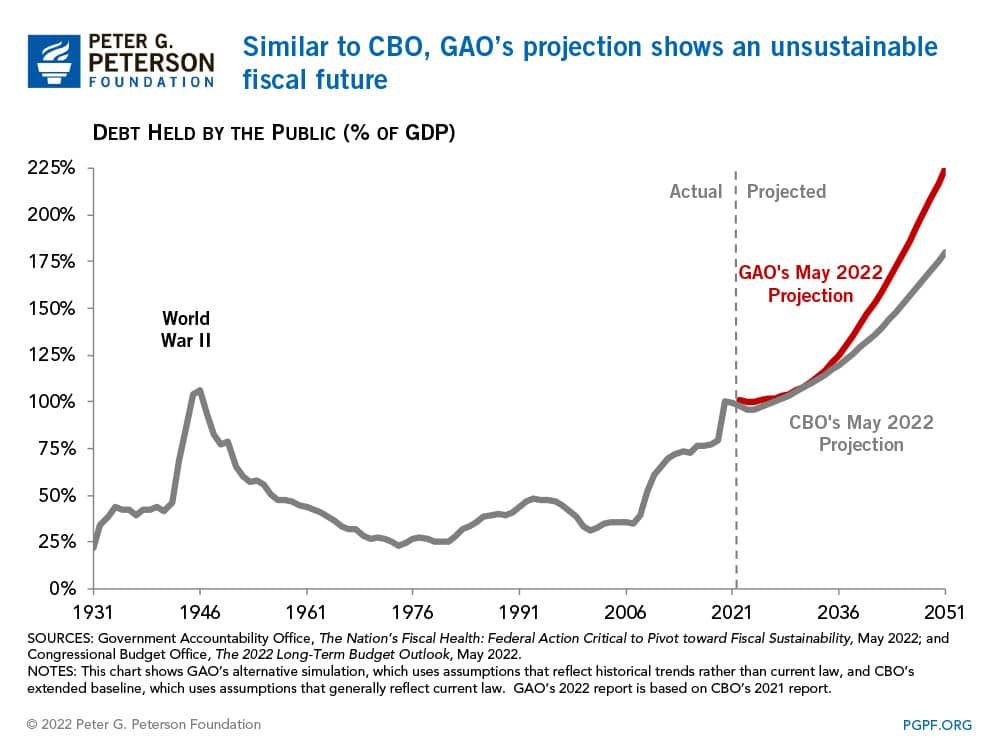

National Debt Could Be Over Twice the Size of the Economy in Just 30 Years

Last Updated July 13, 2022

A recent report released by the nonpartisan Government Accountability Office (GAO) echoes analysis from the Congressional Budget Office (CBO) and the Administration in warning that federal debt is on an unsustainable path. GAO projects that debt held by the public could more than double over the next 30 years — rising from around 100 percent of gross domestic product (GDP) at the end of fiscal year 2021 to 217 percent in 2050.

Although GAO’s projections are based on estimates from CBO that were issued last year, their findings are similar to recent reporting from CBO that focuses on the structural factors driving an imbalance between spending and revenues:

- Growth in Spending. GAO’s report highlights that federal spending in the future will be driven by increases in healthcare programs, Social Security, and net interest. Each of those spending categories are projected to grow faster than the economy over the next 30 years. By 2050, GAO estimates that federal spending on healthcare and Social Security combined will equal 14.8 percent of GDP, up from 10.2 percent in 2019. Much of that increase is associated with the aging population and the rapidly rising cost of healthcare. Net interest will grow substantially in the long term, eventually becoming the largest “program” in the federal budget within the next 30 years as a result of mounting debt and higher interest rates.

- Inadequate Revenues. GAO’s assumption about revenues through 2031 match CBO’s revenue projections. For those years, projections are based on the expectation that current laws, such as temporary reductions in income tax rates, will expire; on average over the 2023-2031 period, revenues would average 17.8 percent of GDP. After 2032, GAO makes a simplifying assumption that revenues will remain constant at 17.3 percent of GDP, their 50-year historical average. Such levels of revenues are a contributor to GAO’s assertion that “action is needed to change the unsustainable fiscal path.”

GAO’s findings add to a chorus of nonpartisan evidence and analysis showing that action is needed to improve our fiscal outlook so that we can meet future challenges, invest in the next generation, and build a strong and inclusive economy.

Image credit: Photo by Matthijs Bettman / EyeEm / Getty Images

Further Reading

Growing National Debt Sets Off Alarm Bells for U.S. Business Leaders

Debt rising unsustainably threatens the country’s economic future, and a number of business leaders have signaled their concern.

What Is R Versus G and Why Does It Matter for the National Debt?

The combination of higher debt levels and elevated interest rates have increased the cost of federal borrowing, prompting economists to consider the sustainability of our fiscal trajectory.

High Interest Rates Left Their Mark on the Budget

When rates increase, borrowing costs rise; unfortunately, for the fiscal bottom line, that dynamic has been playing out over the past few years.