Last Year’s Tax Law Did Not Simplify the System — It Added More Tax Breaks

Last Updated August 13, 2018

The United States tax code is filled with loopholes, deductions, exemptions, credits, and preferential rates; such preferences are known as tax expenditures. Many economists, policymakers, and analysts believe it would help the economy to do away with some or all of those tax breaks to make the code more simple, efficient, and fair.

Last year’s tax legislation was a key opportunity to do just that, but in addition to adding significantly to our national debt, the Tax Cuts and Jobs Act actually increased the number of tax breaks.

According to the Joint Committee on Taxation (JCT), prior to enactment of the Tax Cuts and Jobs Act, there were 216 tax expenditures; now 223 exist.

While the Tax Cuts and Jobs Act eliminated or modified some existing tax expenditures, it also created new ones. Notably, the legislation reduced two of the largest tax expenditures—the state local tax and mortgage interest deductions. However, it also expanded some tax expenditures such as the Child Tax Credit and created new provisions such as the deduction for pass-through business income.

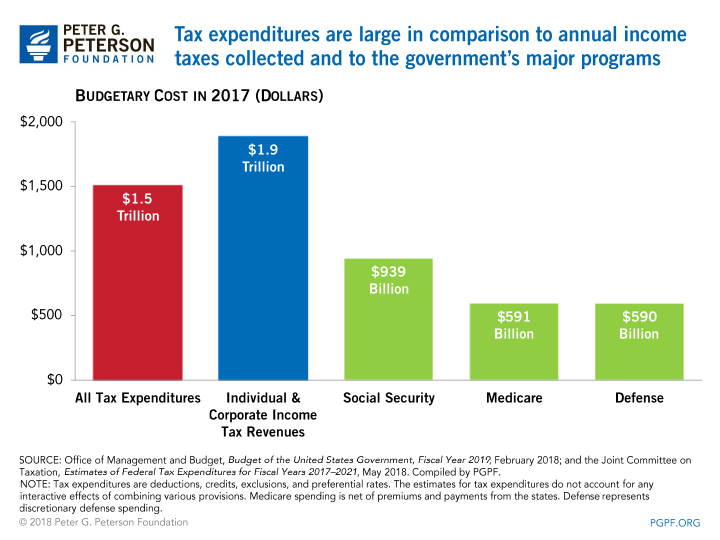

All told, JCT estimates that between 2016 and 2017 the total cost of all tax expenditures stayed roughly the same at $1.5 trillion. The total value of tax expenditures remains large in comparison to important government programs. For example, we spend more on tax expenditures than we do on Medicare and Defense combined. Because the Tax Cuts and Jobs Act didn’t reduce the overall cost of tax expenditures, there is still an opportunity to simplify the tax code and reduce future deficits by examining remaining tax breaks.

Image credit: Photo by Justin Sullivan/Getty Images

Further Reading

Should the U.S. Change the Corporate Tax Rate in 2025?

Here’s why lawmakers lowered the corporate tax rate in 2017, how the lower rate impacted the U.S., and how the rate might be reformed in 2025.

What is a Wealth Tax, and Should the United States Have One?

Proponents of the wealth tax argue that it could help address rising wealth and income inequality while also generating revenues.

What Are Refundable Tax Credits?

The cost of refundable tax credits has grown over the past several years, with the number and budgetary impact of the credits increasing.