How Have States Used Their Direct COVID Relief Funds?

Last Updated January 14, 2022

America’s small businesses have been severely impacted by the economic downturn caused by the pandemic — and lawmakers have focused a significant part of federal relief on helping this critical part of our economy.

As of March 2021, six pieces of legislation have been enacted to help the United States cope with the economic impact of COVID-19. Taken together, those COVID relief bills will cost a total of $5.3 trillion — $968 billion of which has been targeted to small businesses, though total available funding for various loan programs exceeds the net cost associated with the program, as businesses are expected to repay a portion of their loans. Lending from the Federal Reserve provided a small amount of additional support, but the lending program that most directly impacted small businesses expired on January 8, 2021. Below is a review of the elements of assistance for small businesses.

Paycheck Protection Program ($823 Billion, Net Cost)

The Paycheck Protection Program (PPP) was enacted by the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020 and was most recently extended in March of this year. The terms of the program have evolved since it was first created, but it provides federally backed loans to incentivize small businesses to maintain their payroll during the crisis; those loans would be forgiven if used for certain expenses and if employment and compensation levels are maintained.

Who Is Eligible?

Nonprofits, self-employed individuals, independent contractors, and small businesses that were impacted by the pandemic may apply for loans through the end of May. If businesses were forced to shut down, they remain eligible for a smaller loan than businesses that continue to operate.

How Is the Loan Calculated?

Most businesses are eligible to borrow 250 percent of their average monthly payroll expenses, up to a total of $10 million. From January–May 2021, businesses that previously received PPP loans may apply for a second draw loan of up to $2 million, and borrowers in the accommodation and food services sector are eligible for loans of up to 350 percent of their monthly payroll expenses, up to $2 million. The portion of the loan used for payroll expenses, interest payments, rent, and utilities will be forgiven.

How Is the Loan Administered?

The PPP portion of the CARES Act made significant changes to an existing Small Business Administration (SBA) loan program. The PPP is largely administered through private banks and credit unions previously approved by the SBA, but other lenders have also been enrolled.

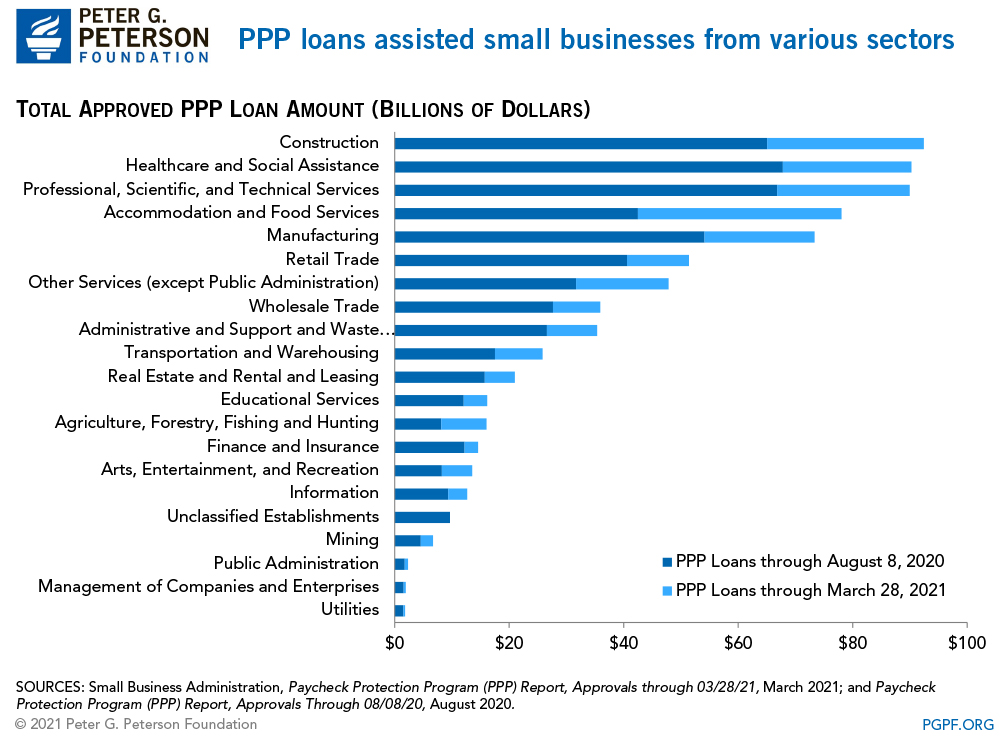

As of March 28, 8.7 million PPP loans had been issued, totaling $734 billion, and with an average loan size of about $84,000. Those loans were made to various sectors, with businesses in construction; healthcare; and professional, scientific, and technical services among those receiving the most funds.

The federal government provided $512 billion in direct financial assistance to help state and local governments cover their expenditures and revenue losses associated with the coronavirus (COVID-19) pandemic. So far, about $400 billion of that total has been disbursed. Here are some notable trends showing how lower levels of government have spent some of their relief funds using a database compiled by the National Conference of State Legislatures (NCSL).

Coronavirus Relief Fund ($150 billion)

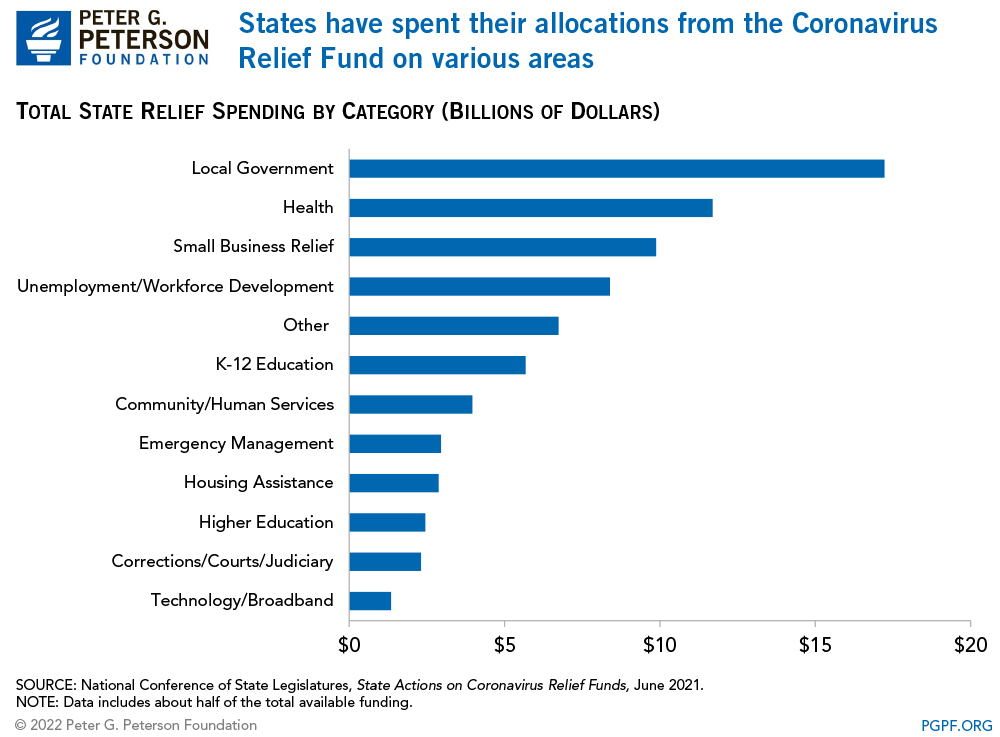

The Coronavirus Relief Fund, created by the CARES Act, provided $150 billion to help state and local governments cover necessary expenditures tied to the COVID-19 pandemic that were incurred between March 2020 and December 2021. About $139 billion was allocated to state and local governments, with the remaining $11 billion allocated to the District of Columbia, U.S. territories, and tribal areas. The federal government has disbursed the full $150 billion from the Coronavirus Relief Fund to recipients; but NCSL’s database indicates that as of June 2021, state and local governments have committed only about half of the funds they received to various projects. Such funding was distributed for the following purposes:

Local Government Support

States targeted at least $17 billion of their relief funds (23 percent of the reported amount) to provide financial assistance to cities, towns, and counties that did not receive direct aid from the federal government. Only 154 cities and counties, less than one percent of the total, received direct federal aid from the CARES Act because such direct payments were limited to local governments with a population of 500,000 or more.

Healthcare Spending

At least $12 billion, or 15 percent of the reported funding, went towards public health efforts associated with the pandemic, including purchasing COVID-19 testing equipment, establishing temporary medical facilities, and supporting contact tracing efforts.

Small Business Support

States utilized $10 billion or more of federal relief funds (13 percent of the reported amount) to provide financial assistance to small businesses, often in the form of grants that target specific industries or groups. For example, Rhode Island provided $10 million in grants to minority-owned businesses.

Unemployment Benefits and Workforce Development

More than $8 billion of the reported federal relief funds (11 percent) were used by states to replenish their unemployment funds as well as to establish new, pandemic-related programs such as enhanced benefits for unemployed workers and virtual job training.

Other

States also spent relief funds on other activities including helping schools prepare for expenditures related to testing, training, and cleaning; providing assistance to renters and homeowners at risk of eviction or foreclosure; and supporting nonprofit and community organizations.

Coronavirus State and Local Fiscal Recovery Funds ($362 billion)

The American Rescue Plan, which was passed in March 2021, established the Coronavirus State and Local Fiscal Recovery Funds to provide $362 billion for:

- Direct aid to state governments ($195 billion)

- Support for local, territorial, and tribal governments ($157 billion)

- Critical capital projects ($10 billion)

Recipient governments have until December 2024 to commit their funds and until 2026 to spend them. Some governments received all of their funding in one payment, while others received half of their allocations in May 2021 and will receive the remaining half one year later. As of December 2021, approximately $249 billion, or two-thirds of the total, has been disbursed from the fund.

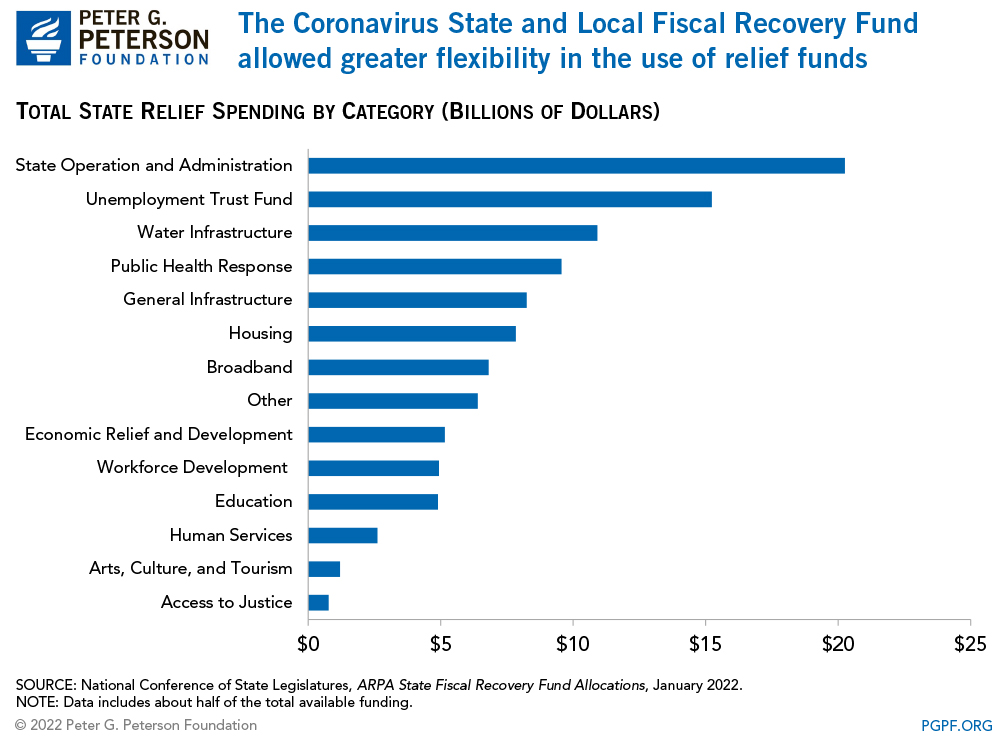

The Fiscal Recovery Funds have focused more on recovery than on immediate relief from the pandemic-induced downturn, giving states greater flexibility to apply their relief funds to various types of activities. In addition, the American Rescue Plan provided meaningfully larger direct relief to local governments, thereby relieving states from the need to suballocate their funds to cities, towns, and counties. NCSL’s information provides data on approximately $105 billion (42 percent) of direct aid allocations received through January 3, 2022. Some notable spending areas include:

State Operation and Administration

The latest COVID-related legislation allowed states to use relief funds to replace lost public-sector revenues. As such, state operation and administration has been one of the largest categories of relief spending so far ($20 billion, or 19 percent, of the reported amount). States have also used funds to hire additional personnel and purchase equipment to administer pandemic-related programs and auditing of them.

Infrastructure

Investments in critical infrastructure needs have been one of the main authorized uses for relief funds from the Fiscal Recovery Fund. At least 25 states have allotted $19 billion (18 percent) of the federal relief to infrastructure related to broadband, water, and sewer.

Other Programs

States have also continued to use federal relief on priorities that were supported with funds from the Coronavirus Relief Fund, including unemployment benefits, healthcare costs, and housing security.

How Effective Was the Federal Support in Helping States Recover?

Overall, the substantial federal support, as well as a strong economic recovery, have helped avert severe state budget crises. Accounting for all federal aid, state revenues surpassed pre-pandemic levels by the end of 2020 and were 23 percent higher in the third quarter of 2021 than in the first quarter of 2020. In fact, some experts have argued that the size of the direct payments to states provided through the Coronavirus State and Local Fiscal Recovery Fund was outsized relative to the pandemic’s impact on state finances, citing that the large amount of federal support may incentivize states to make tax cuts that would damage their long-term finances. Meanwhile, other analysts contend that federal aid provides states with an opportunity to make long-term investments — particularly in lower-income communities that have been hardest hit by the pandemic to ensure equitable economic recovery and growth.

However, there have been ongoing concerns about the need for more accountability, particularly in light of recent cases of fraudulent use of COVID aid money. Given the need for a quick response, the Department of Treasury had to disburse payments while guidelines for auditing recipients of the Coronavirus Relief Fund and Fiscal Recovery Fund were still under development, according to the Government Accountability Office. Many governments have also reported that they lack the capacity to efficiently disburse the funds or report on their use of relief funds consistent with the federal requirements. As states continue to expend their relief funds — and as the pandemic endures with the Omicron variant emerging — the federal government has an important opportunity to examine the impact of earlier funds, looking at ways to ensure ongoing effective distribution of the money for allowable purposes.

Photo by John Moore/Getty Images

Further Reading

Republicans Considering Costly Tax Cut Proposals

Leaders in Congress and the Administration have outlined a broad package of tax cuts that could total $9.1 trillion.

Why Do Budget Baselines Matter?

Applying the current-policy baseline would not only be fiscally irresponsible in terms of this year’s tax debate, but it would set a dangerous precedent for the future.

Social Security Reform: Options to Raise Revenues

Here are the pros and cons for three approaches to increasing funds dedicated to Social Security.