Five Charts about the Future of Social Security and Medicare

Last Updated June 2, 2022

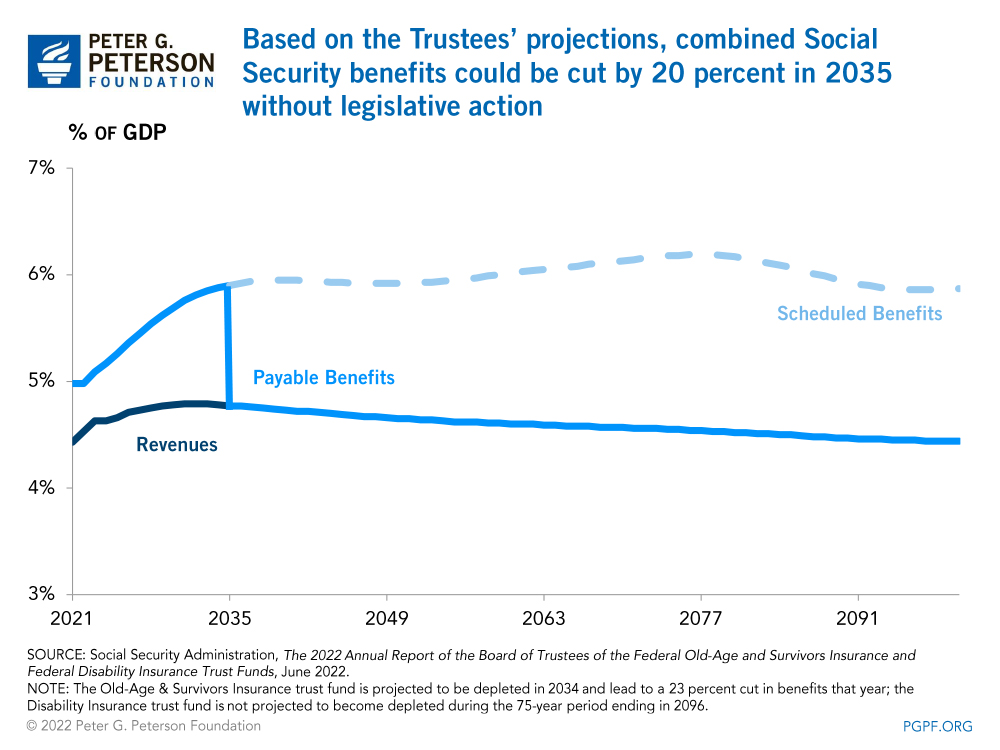

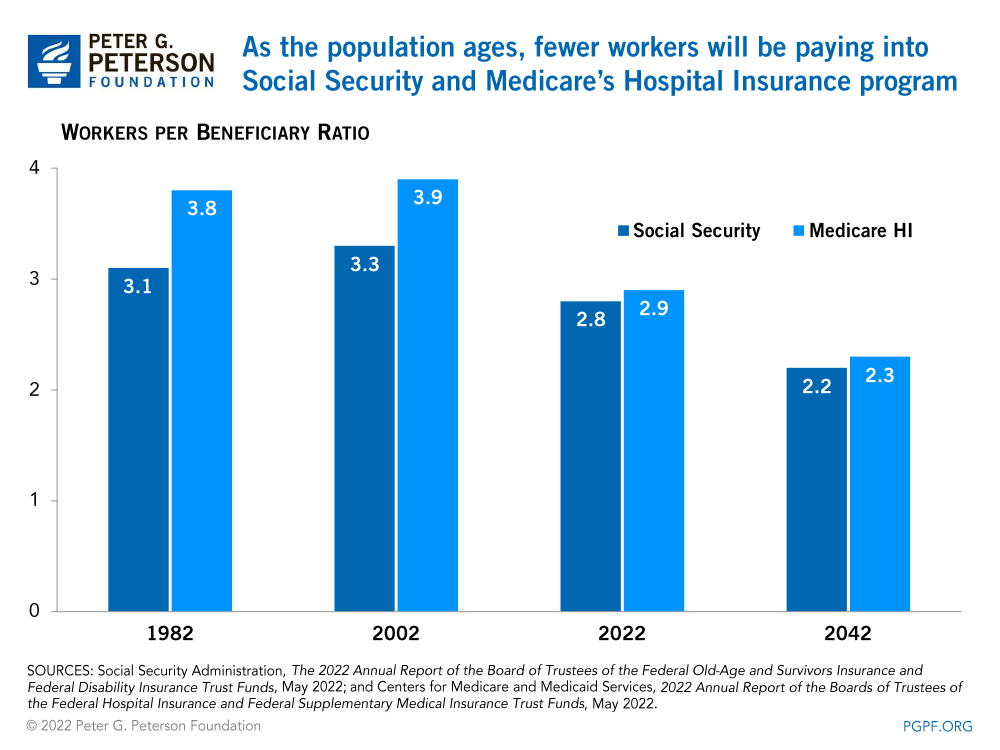

On June 2, the Social Security and Medicare Trustees released their annual reports, which show that these vital programs are on an unsustainable path. In 2022 and all later years, Social Security (the combination of retirement and disability programs) will spend more than it takes in and by 2035, the combined Social Security Trust Funds are projected to be depleted. Medicare’s Hospital Insurance (HI) Trust Fund will be depleted even sooner — in 2028 — although that date is two years later than reported last year, mostly because of higher projections of payroll tax revenues. Nevertheless, the aging of the population and increasing healthcare costs continue to put pressure on the programs and, without action, benefits in the future would be significantly reduced after the dates of depletion.

Below are five key takeaways from the reports.

1.The two Social Security Trust Funds combined would be exhausted in 2035, at which point all Social Security benefits could be cut by 20 percent. Viewed individually, the Old-Age & Survivors Insurance Trust Fund is projected to be depleted in 2034 and lead to a 23 percent cut in benefits that year; the Disability Insurance Trust Fund is not projected to become depleted during the 75-year period ending in 2096.

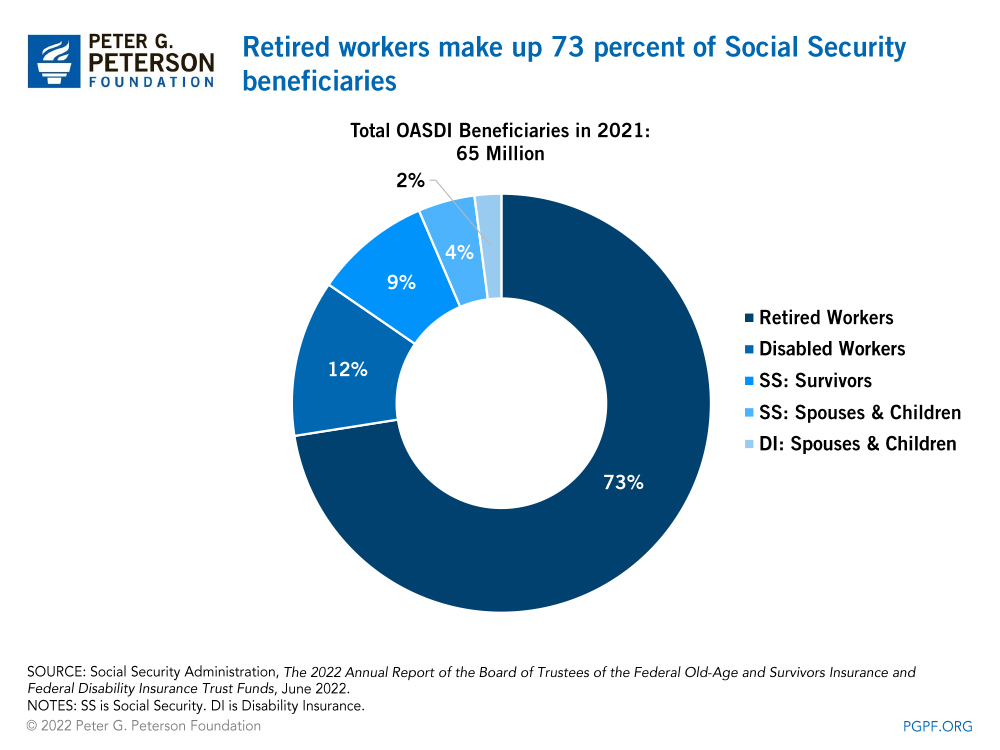

2. There are currently 65 million Social Security beneficiaries, 73 percent of whom are retired workers. Beneficiaries also include disabled workers, as well as survivors, spouses, and children of beneficiaries.

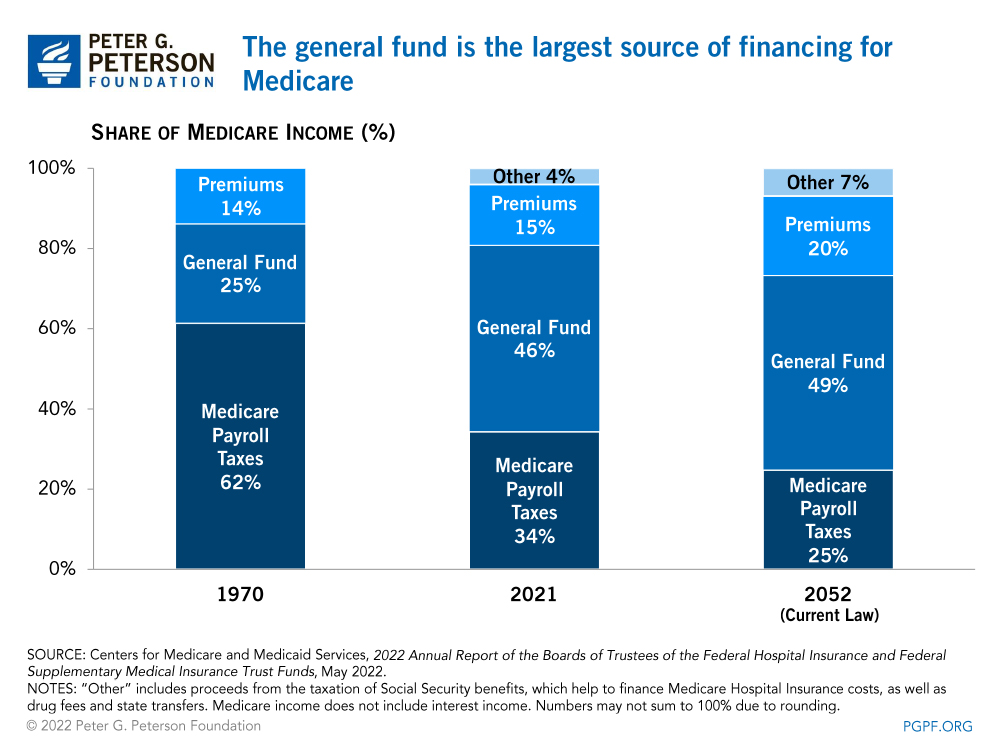

3. While Medicare is funded in part by payroll taxes, the largest source of financing currently comes from the federal government’s general fund. The share of Medicare financed by the general fund is projected to continue to grow, which would put pressure on the federal budget.

4. One of the major drivers of Medicare and Social Security costs is the aging of the population. For example, as the large baby boom generation retires, both Social Security and Medicare’s Hospital Insurance program will have fewer revenue-contributing workers for each beneficiary.

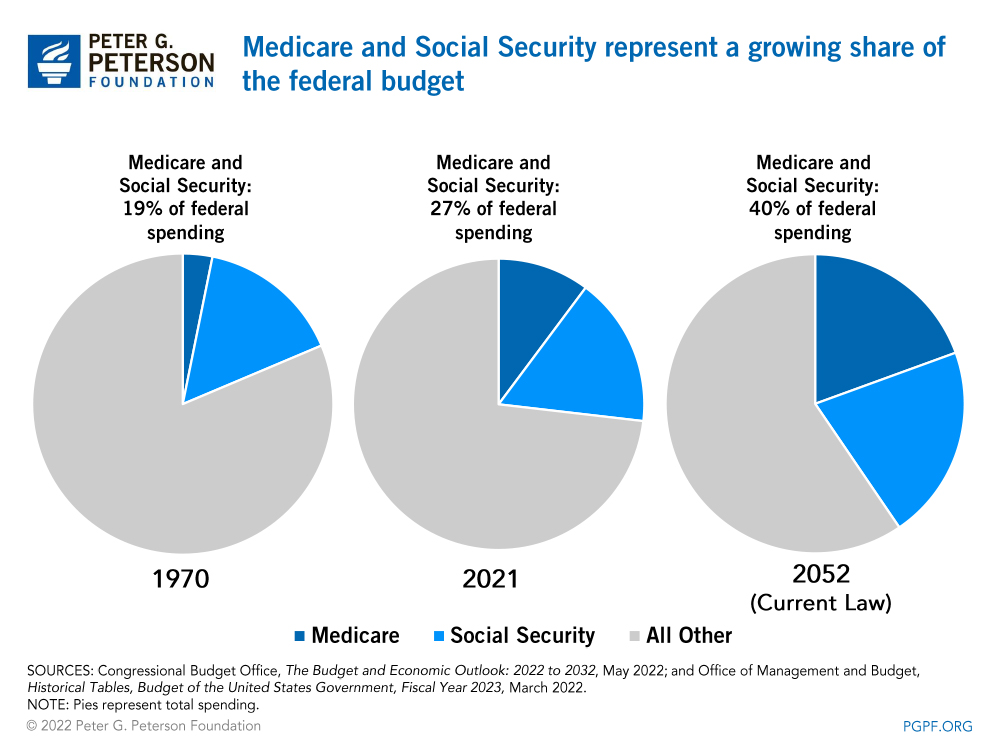

5. As the population ages and healthcare costs rise, Social Security and Medicare will take up an increasingly large portion of the federal budget. As those programs continue to grow, other spending, including important investments in areas such as education and infrastructure, could be crowded out.

Image credit: Getty Images

Further Reading

7 Key Facts About Rising Healthcare Spending in the U.S.

Healthcare spending in the United States is a key driver of the nation’s fiscal imbalance and has risen notably over the past few decades.

What Is the Farm Bill, and Why Does It Matter for the Federal Budget?

The Farm Bill provides an opportunity for policymakers to comprehensively address agricultural, food, conservation, and other issues.

Social Security Reform: Options to Raise Revenues

Here are the pros and cons for three approaches to increasing funds dedicated to Social Security.