First Economic Growth Report under the Coronavirus: Real GDP Falls 4.8% in First Quarter

Last Updated April 29, 2020

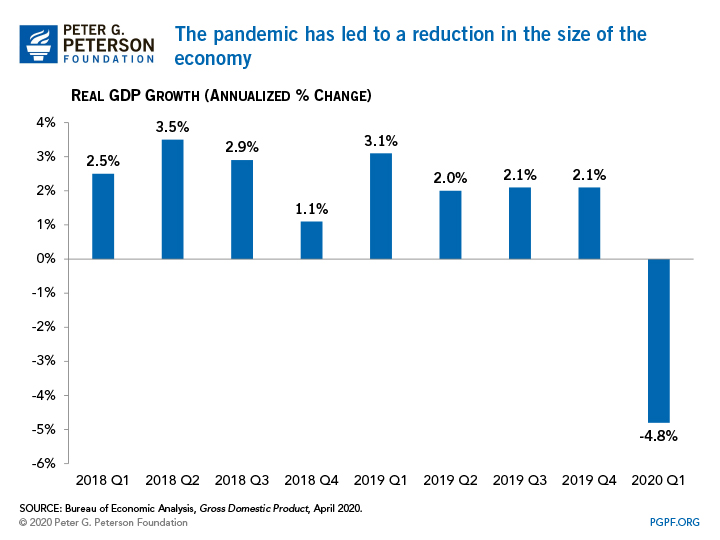

Real (inflation-adjusted) gross domestic product (GDP) contracted by an annual rate of 4.8 percent in the first quarter of 2020, according to this week’s announcement by the Bureau of Economic Analysis (BEA). The decline recorded from January to March represents an early indication of how economic activity in the United States has been affected by the coronavirus (COVID-19) pandemic. Though this report shows a significant impact on our economy already, most of the effects of the pandemic and economic shutdown will be reflected in the second quarter (April through June) of this year.

The decrease in GDP in the first quarter was driven by a decline in consumption and investment. Personal consumption expenditures decreased by 7.6 percent relative to last quarter, while private investment decreased by 5.6 percent. Increases in government spending, including a 1.7 percent increase in federal spending, partially offset those negative contributions.

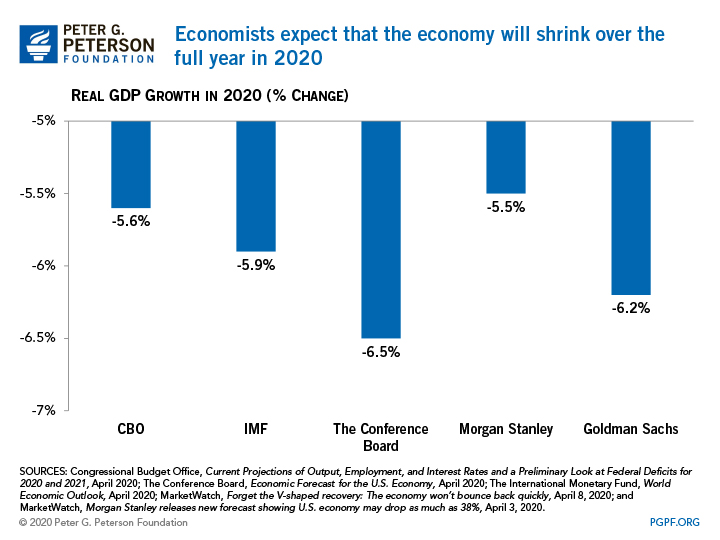

While the release by the BEA represents one of the first looks at the actual decline over the first three months of the year, projections for GDP for the remainder of 2020 are also beginning to emerge and are showing a bleak economic outlook for the near future. Last week, the Congressional Budget Office released a preliminary estimate of the country’s economic and fiscal outlook for 2020 and 2021; in their assessment, the economy will contract by 5.6 percent for the full year in 2020 and grow by 2.8 percent in 2021. The International Monetary Fund (IMF), in its April update of the World Economic Outlook, projects that the United States economy will contract by 5.9 percent this year. The IMF projects growth of 4.7 percent in 2021.

Such projections are in line with those of private sector economists and research organizations. For example, The Conference Board, a research group, forecasts a contraction of 6.5 percent in 2020. Morgan Stanley and Goldman Sachs, both investment banks, anticipate a downturn of 5.5 and 6.2 percent this year, respectively.

we can expect, but those early estimates supplement data on unemployment to provide an initial picture of how the COVID-19 pandemic has affected our economy. Needless to say, the impact has been severe and is widely felt, and the road to recovery will be long.

Image credit: Photo by Chris Graythen/Getty Images

Further Reading

National Debt Puts Upward Pressure on Inflation and Interest Rates

America’s unsustainable fiscal outlook can have “significant consequences for price stability, interest rates, and overall economic performance,” according to a new report.

Why Is the Federal Deficit High If Unemployment Is Low?

The U.S. is experiencing an unusual and concerning phenomenon — the annual deficit is high even though the unemployment rate is low.

What Is Inflation and Why Does It Matter?

Here’s an overview of inflation, why it matters, and how it’s managed.