Coronavirus Executive Actions Highlight Our Broken Budget Process

Last Updated August 10, 2020

Over the weekend, while policymakers in the House and Senate seemed to be at a standstill in negotiations on the next legislative package to help address the economic effects of the pandemic, President Trump signed executive actions related to unemployment insurance, payroll tax relief, student debt, and housing evictions. Those actions seem to have raised more questions than answers for many about who can enact federal spending and tax policies.

Regardless of whether the actions are upheld, budgetary decisions are best made through a transparent process in which all participants carry out their assigned roles. Responsible budgeting is one of the most important functions of the federal government. Ideally, following a logical process that leads to thoughtful policymaking would be the best way to contribute to a sustainable fiscal outlook and a healthy economy.

To learn more about the U.S. budget process — and how it is supposed to work — visit the sources below:

- Understanding the Budget Process

- Budget Process Solutions

- Introduction to the Federal Budget Process (Congressional Research Service)

Image credit: Photo by Getty Images

Further Reading

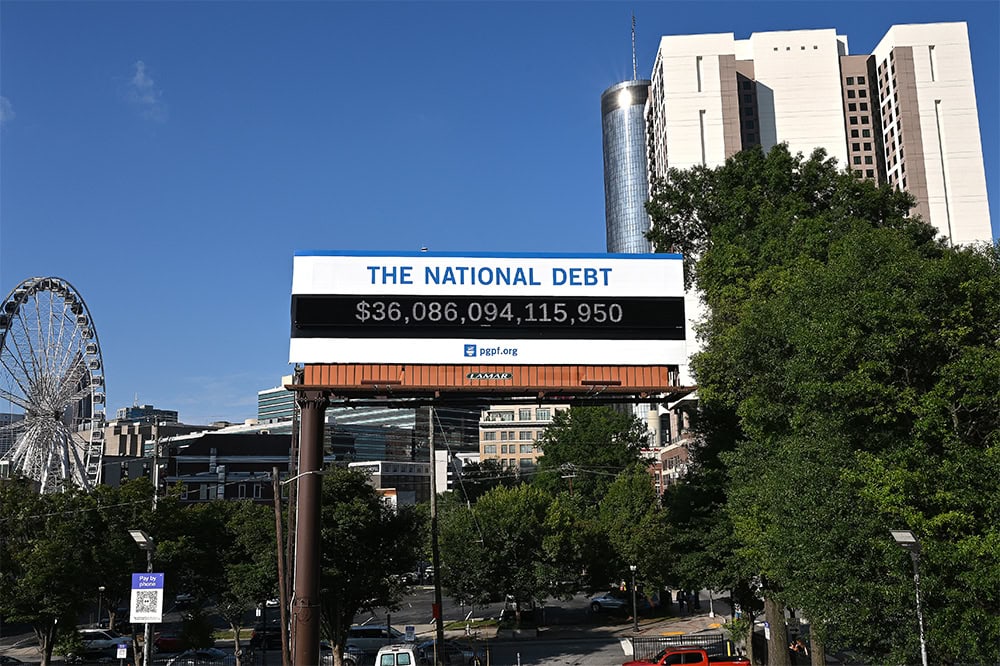

Growing National Debt Sets Off Alarm Bells for U.S. Business Leaders

Debt rising unsustainably threatens the country’s economic future, and a number of business leaders have signaled their concern.

Infographic: The National Debt Is Now More than $36 Trillion. What Does That Mean?

Although the national debt affects each of us, it may be difficult to put such a large number into perspective.

The U.S. Just Had Its Highest Deficit Outside of Major War or Recession

One of the reasons to restrain debt and maintain a sustainable fiscal outlook is that emergencies arise that may necessitate federal support.