In late September, Congress narrowly avoided a government shutdown by passing a continuing resolution (CR) just two days before the close of fiscal year 2016. The stopgap legislation kept the government operating in the short term, but lawmakers face a series of additional budgetary challenges in coming weeks and months:

- December 9, 2016 — Continuing Resolution: To prevent a government shutdown, lawmakers will need to enact additional legislation that provides appropriations for discretionary programs on or before this date. Only one of the 12 regular appropriations bills has passed thus far.

- December 31, 2016 — Expiring Tax Provisions: Congress will face decisions about whether to renew 36 tax provisions that expire on December 31, 2016. These include provisions such as tax credits for renewable energy and special deductions, including tuition expenses, race horses, and NASCAR tracks.

- March 15, 2017 — The Debt Ceiling: The Bipartisan Budget Act of 2015 suspended the debt ceiling through March 15, 2017. Lawmakers must act to raise or suspend the debt limit again before that date, or risk a default on Treasury obligations, which could severely damage our economy and our nation’s global standing.

- April 15, 2017 — Budget Resolution: Congress faces a statutory deadline for adopting a budget resolution for fiscal year 2018. Lawmakers should work together to adopt and develop a budget resolution that addresses our long-term fiscal challenges and provides much needed certainty to the budget process.

In addition to near-term issues, our nation faces serious long-term fiscal imbalances that threaten to undermine economic growth. In 2016, for the first time since 2009, the deficit began rising as a share of GDP. Lawmakers should use our annual budget process as an opportunity to set long-run policy priorities for spending and revenues that provide greater certainty about our nation’s fiscal policy.

Image credit: Getty Images

Further Reading

Growing National Debt Sets Off Alarm Bells for U.S. Business Leaders

Debt rising unsustainably threatens the country’s economic future, and a number of business leaders have signaled their concern.

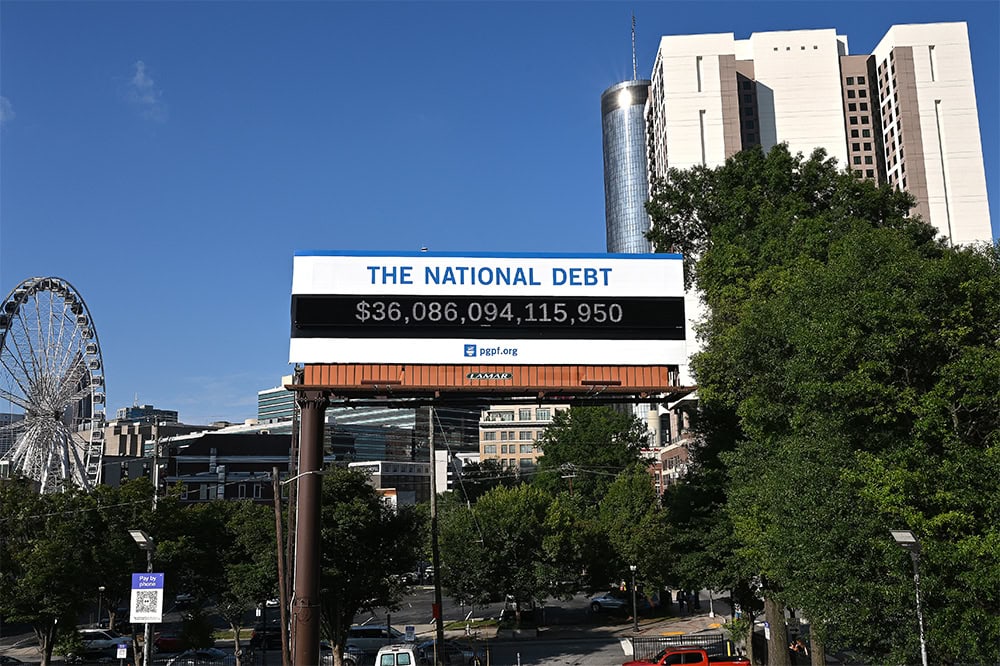

Infographic: The National Debt Is Now More than $36 Trillion. What Does That Mean?

Although the national debt affects each of us, it may be difficult to put such a large number into perspective.

The U.S. Just Had Its Highest Deficit Outside of Major War or Recession

One of the reasons to restrain debt and maintain a sustainable fiscal outlook is that emergencies arise that may necessitate federal support.