The American Rescue Plan Is Projected to Boost the Economy by 73¢ for Every Dollar Spent

Last Updated January 5, 2022

In March 2021, President Biden signed the American Rescue Plan (ARP) Act into law, the sixth major COVID-19 relief bill to be passed by Congress. The Congressional Budget Office (CBO) estimated that it would cost $1.9 trillion over a decade. The ARP was intended to aid the country in its fight against COVID-19 as well as accelerate the nation’s recovery from the pandemic-induced economic recession.

As such, the ARP included spending on both public health related programs as well as initiatives that were generally meant to improve the economic standing of ordinary Americans. The law created new programs and expanded certain relief measures from the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which was enacted at the beginning of the pandemic in March 2020.

Major programs in the ARP included direct payments to Americans; aid to state, local, and tribal governments; expansion of unemployment benefits; tax incentives such as expansions of the Child Tax Credit and Earned Income Tax Credit; public health spending; and support for education.

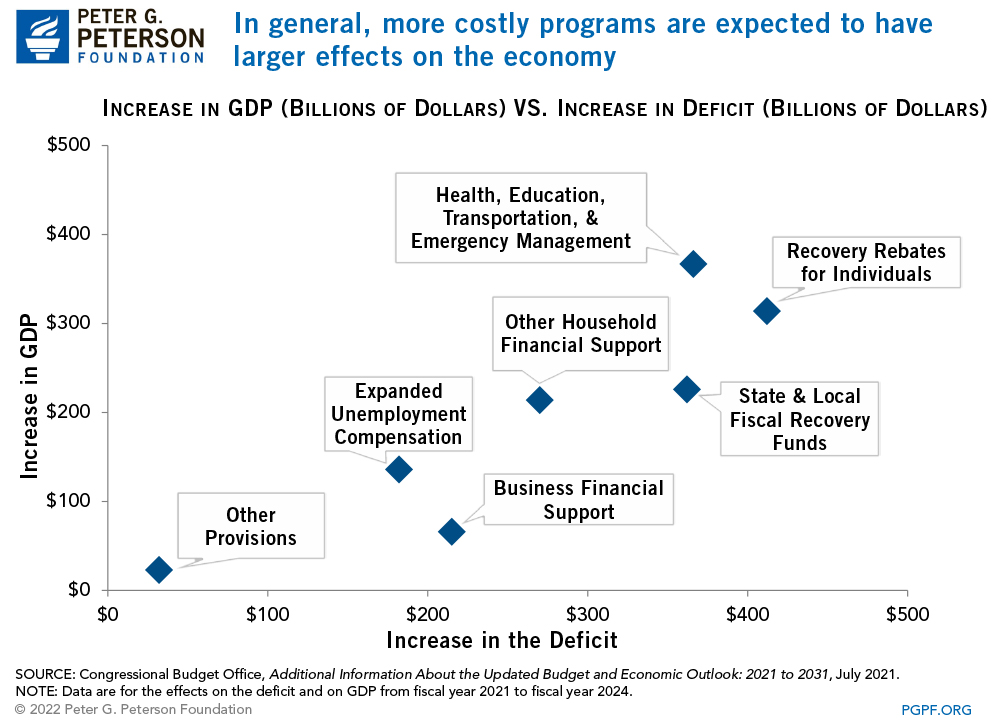

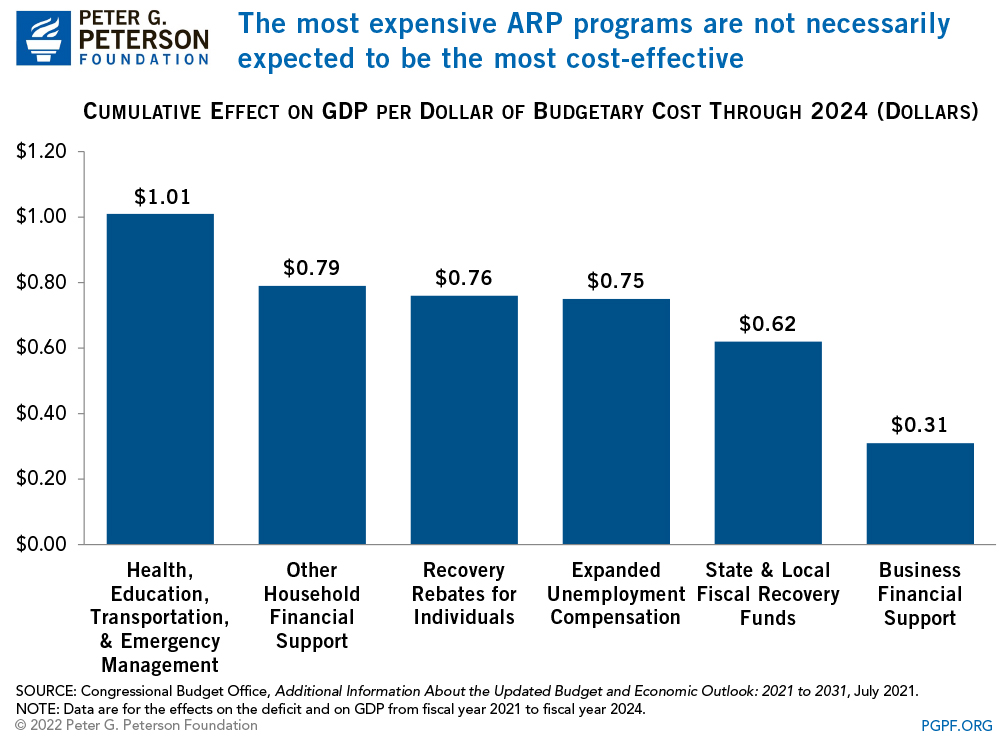

Now that many of those programs have been implemented and a significant portion of the funding has been spent, CBO has estimated how various programs will impact the economy. Below are two charts that provide insights on the anticipated effectiveness of major ARP programs.

Which ARP Programs Are Most Effective?

The costliest measures are expected to stimulate the economy the most. In particular, CBO indicates that spending on health, education, transportation, and emergency management (which generally increases government spending on a variety of goods and services); direct payments to individuals; and state and local fiscal recovery funds may contribute the most to economic growth. Below is a chart that plots the projected cost and associated contributions to gross domestic product (GDP) of major ARP programs.

Although the costliest measures are anticipated to contribute the most to the economy, CBO found those measures are not necessarily expected to provide the most bang for the buck. One way to measure the cost-effectiveness of programs is to determine how much each dollar of spending increases GDP. The chart below shows that most ARP programs are projected to be relatively cost-effective, with the total contribution to the economy expected to be a $0.73 increase in GDP for each dollar spent. Notably, financial support for businesses is projected to be less cost-effective while spending on health, education, transportation, and emergency management is expected to essentially pay for itself.

The findings above can help lawmakers understand how different relief measures may impact the economy and serve as lessons learned. The legislative response to COVID-19 has been an essential part of supporting Americans and the economy through this crisis. However, the pandemic accelerated existing structural fiscal challenges for our nation — challenges that existed long before COVID-19 and that we will have to address to ensure that we are stronger and more prepared for the future.

Image Credit: Spencer Platt/Getty Images

Further Reading

Some Tax Provisions Are Expiring in 2025 — Here’s What Experts Think About Them

The TCJA lowered taxes for millions of households and made filing simpler for many — all while making the country’s fiscal outlook worse.

How Much Would It Cost to Make the TCJA Permanent?

Most of the individual tax provisions and a handful of business provisions in the TCJA are scheduled to expire in the next few years.

How Did the TCJA Affect Corporate Tax Revenues?

For the first few years after TCJA’s enactment, revenues from corporate taxes dropped sharply, but they returned to pre-TCJA levels starting in 2021.