You are here

Analysis of GAO Update To Federal Government’s Long-Term Fiscal Outlook

EXECUTIVE SUMMARY

On March 21, 2011, the Government Accountability Office (GAO) released its latest update to The Federal Government’s Long-Term Fiscal Outlook. Relative to the GAO’s last update of their long-term simulation, the nation’s fiscal condition has deteriorated. This can be attributed to the slower pace of recovery following the recession. Although it is highly unlikely that lawmakers would allow the budget to develop as the simulations suggest, the report provides important insights on the nation’s budget outlook over the next 75 years under alternate sets of assumptions about current policies and underlying factors affecting federal programs (1).Under any set of assumptions, the report finds that the current fiscal situation is unsustainable.

The report highlights the major role that the growth in health care spending plays in the long-term budget outlook:

- Federal deficits will fall in the short term but once again begin climbing in 2018, eclipsing $1 trillion in 2027 even under the most optimistic set of assumptions.

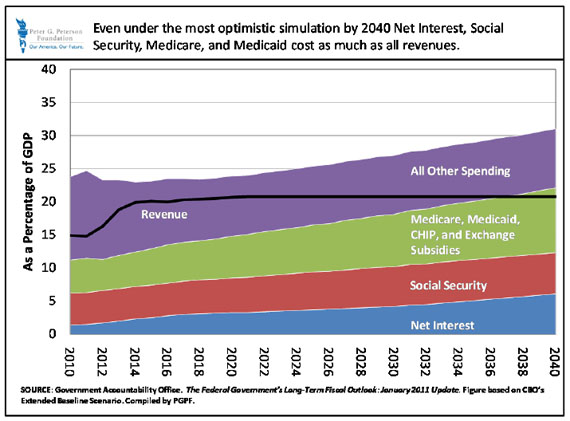

- Even under the optimistic assumptions about the federal government’s ability to control the future growth in health care costs, spending for Medicare and Medicaid, Social Security, and payments for net interest will outstrip revenues by 2037.

- To stabilize the federal debt at its current level of 62 percent of total economic output, or gross domestic product (GDP), taxes would have to immediately and permanently increase by almost 15 percent, spending would have to be slashed permanently by 13 percent, or some combination of the two. If the health care cost control measures contained in the Affordable Care Act are not sustainable in the long run, by 2034, debt held by the public will exceed 200 percent of GDP and interest payments to service the public debt will reach 9 percent of GDP.

Although the future outlook for the budget is uncertain, the GAO’s analysis makes one point clear: our nation’s fiscal problems are large. To address those problems, policymakers will need to develop a credible plan to reduce the deficit gradually over time as the economy recovers. Waiting too long to put the budget on a sustainable track will raise the costs of addressing our nation’s fiscal challenges.

1 The GAO report provides four sets of assumptions: two using Congressional Budget Office (CBO) assumptions about Social Security and major health care benefit programs; and two using slightly different assumptions from the Social Security and Medicare Trustees about those programs. Because the CBO assumptions are consistent with those used in its budget projections, this analysis refers to the CBO scenarios.

THE SIZE OF THE FISCAL PROBLEM

The GAO provides simulations based on an extension of the Congressional Budget Office’s January Budget and Economic Outlook baseline (the Extended Baseline), which assumes continuation of current law, and an Alternative scenario, which, given the past actions of the Congress and the President, assumes that certain laws will be changed. Those include:

- For revenues, individual income tax cuts that are scheduled to expire in 2012 are extended through 2021, and the income exemptions for the alternative minimum tax (AMT) are indexed to inflation through 2021. Beyond 2021, total revenues are brought back to their historical average level of 18 percent of GDP.

- For spending, discretionary spending grows with GDP (instead of with inflation as assumed in the baseline), health care cost control measures contained in the Affordable Care Act are not sustainable beyond 2020, and Medicare physician payments are not reduced as required in current law by the sustainable growth rate formula (SGR).

While the Extended Baseline scenario is more optimistic than the Alternative scenario, large and persistent deficits still lead to an unsustainable growth in debt held by the public and a steady growth in net interest payments to service this growing debt. As the GAO notes in their analysis of the Extended Baseline scenario, by 2030 the growth in net interest payments and the growing cost of entitlements lead to a situation in which little room is left in the budget for all other spending. In the GAO model, “all other spending” is a catch-all category that includes what most people generally think of as government services such as national security, infrastructure, education, and the smaller entitlement programs.

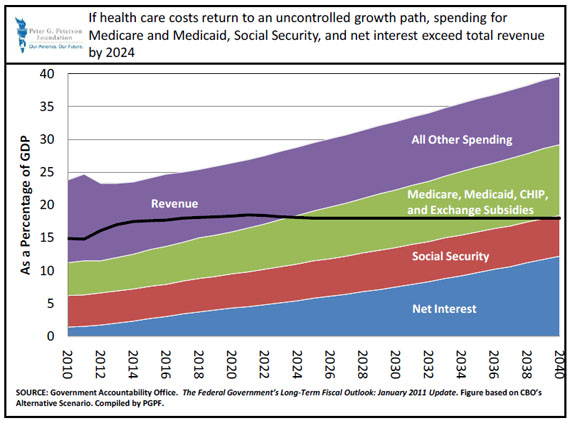

Under the Alternative scenario, some of the cost control measures in the Affordable Care Act are not sustained in the long term, which causes the growth of spending for Medicare, Medicaid, CHIP, and health insurance exchange subsidies to return to an unsustainable path after 2020. Medicare and Medicaid, Social Security, and net interest payments alone outstrip revenue by 2024. By 2036 spending on Medicare, Medicaid, CHIP, and the exchange subsidies is greater than spending for the “All Other Spending” category.

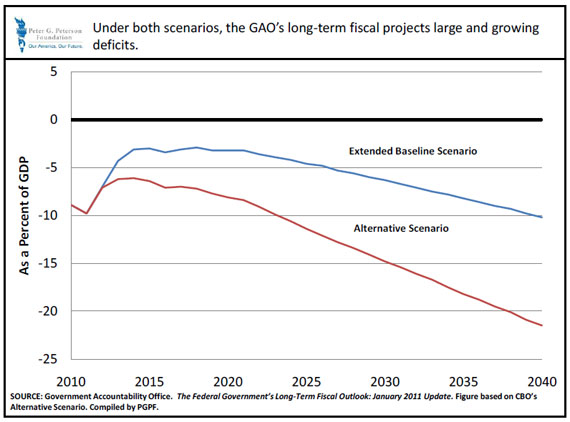

In both the Extended Baseline and Alternative scenarios, the imbalance between spending and revenues leads to large sustained deficits. Deficits decline in the short-term as the economy recovers, but begin to climb again as the cost of providing entitlements and the net interest on the public debt mount. In the Extended Baseline scenario, deficits once again eclipse $1 trillion by 2027. If the more pessimistic assumptions of the Alternative scenario hold, this mark may be passed as soon as 2017.

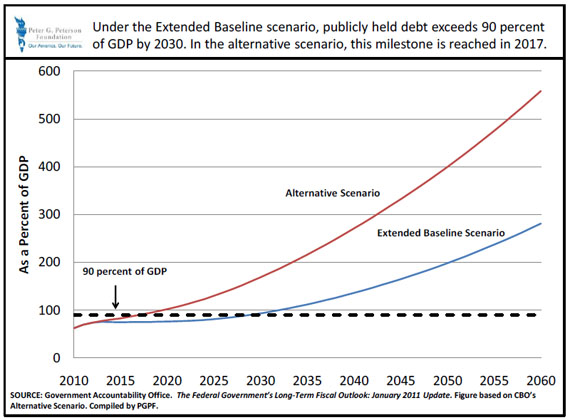

The outcome of these persistent deficits is a sustained growth in federal debt held by the public. Under both scenarios, debt held by the public is on a path to far exceed historically high levels in the medium term. Some economists believe that there is a link between high levels of public debt and sluggish economic growth. Economists Kenneth Rogoff and Carmen Reinhardt conducted research on the experience of several countries that

carried high levels of debt. They found that countries with debts above 90 percent of GDP tended to grow more slowly than countries with lower levels of debt. Under the Extended Baseline, debt held by the public will exceed 90 percent of GDP by 2030. Under the Alternative scenario, debt held by the public reaches 90 percent of GDP by 2017.

The GAO’s simulations can also be used to gauge the magnitude of changes necessary to stabilize the debt. Under the more optimistic projections of the Extended Baseline scenario, in order to hold the public debt at its current level of 62 percent of total economic output through the end of the GAO’s projection period, taxes would immediately and permanently have to increase by almost 15 percent, spending would have to be slashed permanently by 13 percent, or some combination of the two. Under the Alternative scenario, to stabilize the debt, taxes would need to increase by almost 54 percent, all non-interest spending would have to be decreased by 35 percent, or some combination of the two.

To be sure, the GAO is not recommending that the Congress enact large policy changes that cut the deficit immediately. Given the current fragility of the economy, raising taxes or cutting spending too much or too soon could undermine economic growth. However, the GAO’s analysis also shows that waiting too long to take action on the budget also raises costs. Under the optimistic scenario, waiting to act until 2021 would increase the size of the tax hike needed to stabilize the debt by 17 percent.

CONCLUSION

While the GAO simulations are an illustrative exercise, it is clear that the current fiscal situation is unsustainable. Even if the cost control measures contained in the Affordable Care Act are fully implemented and sustainable over the long term, there is a significant imbalance between revenues and spending. It is also clear that to avoid disruptive policy changes, policymakers should adopt a credible plan to cut the deficit. To avoid negative outcomes for economic growth, these policy changes should be phased in slowly.

The Government Accountability Office is an independent, nonpartisan agency that works for Congress. Often called the "congressional watchdog," the GAO investigates how the federal government spends taxpayer dollars. The GAO has published long-term fiscal simulations since 1992.

Download a PDF Version.