Fiscal Confidence Index

The Fiscal Confidence Index tracks the American public’s views about our fiscal and economic condition and the progress elected leaders are making in addressing it. Since its inception, the Fiscal Confidence Index has consistently shown that Americans hold deep concerns about the level of our long-term debt, and they urge policymakers to make our fiscal and economic future a top priority.

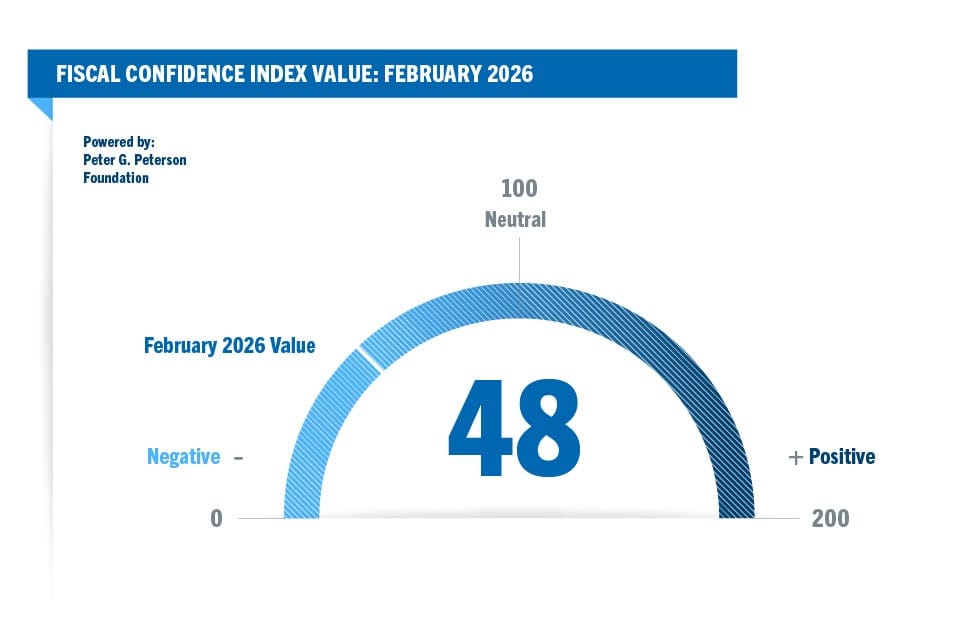

Latest FCI Results

This online poll surveyed 1,004 registered voters nationwide between February 17 and February 18, 2026. For full results, including demographic information, download the January polling memo.

For an analysis of the results, see this month’s press release.

Concern (47)

Priority (26)

Expectations (74)

Historical Results

The Peterson Foundation launched the Fiscal Confidence Index in 2012 to help policymakers, journalists, and the American public gauge public opinion on the nation’s fiscal and economic challenges.

To see detailed results for each month download the polling memos here:

Methodology

The Fiscal Confidence Index, released monthly, is modeled after the Consumer Confidence Index and measures public opinion about the national debt and the economy by asking questions in three key areas:

- CONCERN: Level of concern and views about the direction of the national debt.

- PRIORITY: How high a priority addressing the debt should be for elected leaders.

- EXPECTATIONS: Expectations about whether the debt situation will get better or worse in the next few years.

The individual scores in these three areas are averaged to produce the Fiscal Confidence Index value.

Polling is conducted monthly by the Global Strategy Group and North Star Opinion Research.

As is done with the Consumer Confidence Index, the first step in calculating the Fiscal Confidence Index is determining the "Relative Value" for each question. This calculation is made by taking the positive response for each question and dividing it by the sum of the positive and negative responses. Each question was asked on a four-point scale, and answers were weighted according to intensity, with the strongest responses counting twice as much as the middle responses ("much" better or worse answers count twice as heavily as "somewhat" better or worse answers).

The scores for the Concern, Priority, and Expectations categories are determined by averaging the scores derived from the two questions in each category.

The Fiscal Confidence Index value is converted from the Relative Value to place it on a scale on which 100 indicates equal positive and negative sentiment, while values below 100 indicate negative sentiment and values above 100 indicate positive sentiment.